The ongoing uncertain financial backdrop has shaken investor confidence in stock markets. Many have become apprehensive about jumping into risk-on assets, and so certain sectors of the market have faltered. Post-pandemic, positive trends were mounting to some extent, but then the Russia-Ukraine conflict and rising inflation flipped the narrative.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

These macroeconomic factors have brought on huge volatility, which has dropped investors into murky waters with no ray to find the way to the next move. Investor anxiety has led S&P 500 to drop more than 8% year to date.

In such a gloomy scenario, here comes the need for TipRanks’ Top Smart Score Stocks, a tool which investors can use to understand a well-rounded macro snapshot of a stock.

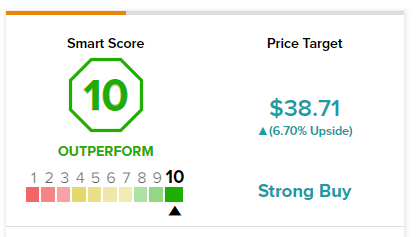

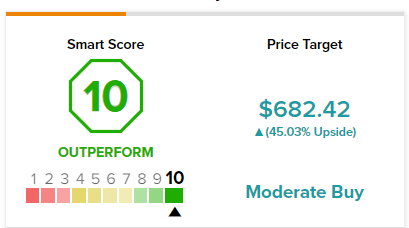

The tool’s method includes rating a stock on a scale of one to ten, with ten being the best, based on eight key indicators, including crowd wisdom and insider trading activities.

After considering TipRanks’ Top Smart Score Stocks recently, let’s take a look at two large-cap stocks which received a “Perfect 10.”

Antero Resources Corporation (AR)

Independent oil and natural gas company Antero Resources received a “Perfect 10” Smart Score rating on TipRanks. The firm is engaged in the exploration, development, and production of natural gas, NGLs, and oil.

With a market capitalization of $11.42 billion, AR stock is trading near 52-week highs and exploded 302.22% over the past year and 104.62% year-to-date.

With sky-high commodity prices due to Russia’s violent invasion of Ukraine, Antero is well-positioned to capitalize on the opportunity. Additionally, the debt reduction strategy of the company and target to return capital to shareholders, along with expected improvement in production has tempted investors to add this stock to their portfolio for long-term gains.

In the last earnings release, Michael Kennedy, CFO of Antero said, “The dramatic reduction in our absolute debt, below $2.0 billion in the first quarter of 2022, enables us to initiate a return of capital program. Going forward we will target returning 25% to 50% of Free Cash Flow annually to our shareholders, beginning with the $1.0 billion share repurchase program that is effective immediately.”

In the soon-to-be-reported quarter, Wall Street expects earnings of $1.15 per share on revenues of $1.46 billion. This indicates more than double earnings expected sequentially from $0.46 per share recorded in the fourth quarter of 2021.

Ahead of the first-quarter earnings release, Wells Fargo analyst Nitin Kumar maintained a Buy rating on the stock and raised his price target to $38 from $36. Kumar’s price target implies 4.74% upside potential over the next 12 months.

Kumar expects Antero to put light on its participation in the global LNG trade, revised its free cash flow outlook for 2022 and 2023, and update on the share repurchase program, during its first-quarter earnings call. The analyst is positive about the free cash flow outlook, which he expects to be driven by a rally in commodity prices.

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Antero, with 26.5% of investors maintaining portfolios on TipRanks increasing their exposure to AR stock over the past 30 days. Furthermore, 3.6% of these individuals have raised their holdings in the recent week.

Overall, consensus among analysts is a Strong Buy based on six Buys versus one Hold. The average Antero price target of $38.71 implies 6.7% upside potential from current levels.

Lam Research Corporation (LRCX)

California-based Lam Research has received a “Perfect 10” Smart Score rating on TipRanks. It manufactures, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits globally. The company offers thin film deposition, plasma etch, photoresist strip, and wafer cleaning.

With a market capitalization of $65.64 billion and recording losses of 34.93% year-to-date, LRCX stock is trading toward its 52-week low price. But supported by its strong fundamentals and financial stability, the company fits in to buy the dips strategy for investors.

In the current era of digitization, the rising global demand for semiconductor chips and microcontrollers promises steady growth for semiconductor manufacturing equipment makers. With huge investments underway to boost chip production by renowned semiconductor manufacturers, Lam Research’s client base, which includes Micron Technology, Inc. (MU), Taiwan Semiconductor Manufacturing Company Limited (TSM), and Samsung, are likely to remain decent contributors to total revenue of the firm in the long run.

After reporting better-than-expected earnings in the December quarter, Lam Research is expected to report earnings of $7.48 per share on revenues of $4.26 billion for the March quarter, to be reported tomorrow after the market close. The company provided a revenue guidance range of $3.95 billion to $4.55 billion, while adjusted earnings are expected in the range of $6.70 to $8.20 per share.

In addition, Lam Research has a long track record of paying dividends, with consecutive increases. The dividend amount has grown from $0.18 per share in 2014 to the current rate of $1.50 per share. The stock offers investors a dividend yield of 1.27%, which compares favorably with the sector average of 0.729%.

Recently, Morgan Stanley analyst Joseph Moore reiterated a Buy rating and a price target of $730 (55.14% upside potential) on Lam Research.

Though Moore has reduced estimates due to ongoing supply challenges, he maintains a bullish stance on long-term expectations. Nevertheless, the analyst believes that despite strong demand, minor supply chain issues might impact revenues in upcoming quarters.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys and six Holds. The average Lam Research price target of $682.42 implies 45.03% upside potential.

In addition, bloggers seem enthused by the company’s prospects. TipRanks data shows that financial blogger opinions are 91% Bullish on LRCX, compared to a sector average of 68%.

Bottom Line

Recent volatility in even historically stable stocks has shaken investors to the point where nothing appears to be safe. The Smart Score snapshot allows for an easy comprehension of a stock’s underlying fundamentals, something invaluable during these turbulent times. Antero Resources and Lam Research each have ‘perfect 10’ scores, despite their recent price action.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure