The pre-sale estimates of Apple’s (AAPL) iPhone 16 indicate a muted response from consumers. This news comes even as the tech giant had high hopes that the new artificial intelligence features would make the iPhone 16 a major success.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Analyst Kuo Estimates a Decline in iPhone 16 Sales

According to a blog post by Ming-Chi Kuo, an Apple analyst at TF International Securities, Apple sold an estimated 37 million units during the first weekend of iPhone 16 pre-sales, a decline of 12% year-over-year. Notably, demand for the higher-priced iPhone 16 Pro models appears to have dropped significantly compared to the launch of the iPhone 15.

Elaborating further, Kuo estimates that Apple sold 9.8 million iPhone 16 Pros and 17.1 million iPhone 16 Pro Max devices in the first weekend. This was a decline of 27% and 16%, respectively, year-over-year. In contrast, sales of the standard iPhone 16 and the Plus version were slightly higher than those of the iPhone 15.

One reason for the lower-than-expected pre-sales estimates for the iPhone 16 Pro models could be due to the shorter shipping times compared to last year, according to Kuo. That is, shipping times of one to two weeks during the first weekend of pre-sales, compared to three to four weeks for the iPhone 15. He pointed out the shorter shipping times to the fact that the highly promoted AI “Apple Intelligence” features are not yet available on the devices.

Other Wall Street Analysts Echo a Decline in iPhone 16 Sales

Wedbush analyst Daniel Ives also echoed a decline in AAPL’s iPhone sales and estimated pre-sales at around 40 million units, only slightly higher than Kuo’s figures. Additionally, Wall Street analysts point out that it is interesting to note that demand for the lower-priced iPhone 16 and iPhone 16 Plus is stronger as the upgrades to the standard iPhone 16 models have made them comparable to the Pro versions in many aspects.

As a result, analysts expect that this trend could have implications for Apple’s average selling price and overall revenue from iPhone sales.

These hiccups aside, overall, Wall Street analysts project that the sales of the iPhone 16 could pick up over the long term.

What Is AAPL’s Target Price?

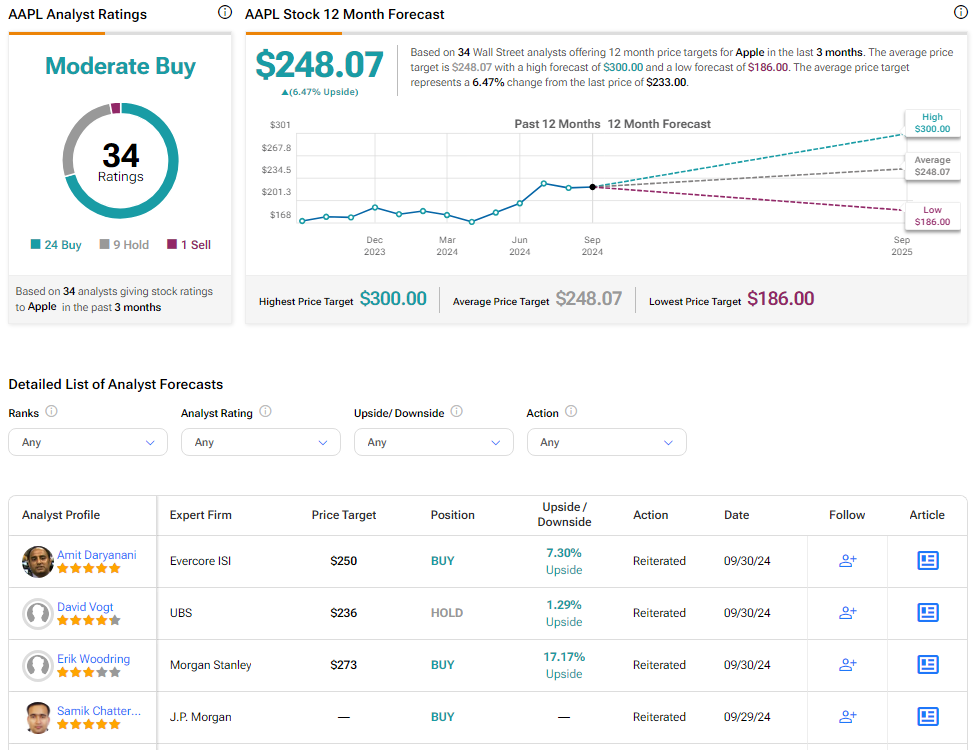

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 24 Buys, nine Holds, and one Sell. Over the past year, AAPL has increased by more than 30%, and the average AAPL price target of $248.07 implies an upside potential of 6.5% from current levels.