The Board of multinational semiconductor company Advanced Micro Devices, Inc. (NASDAQ: AMD) has approved a new share repurchase program of $8 billion. This is in addition to the $4 billion share buyback plan that the company announced in May last year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Out of the $4 billion, AMD has repurchased common shares worth around $3 billion.

The CEO and Chairperson of AMD, Lisa Su, said, “We are pleased to expand our share repurchase program based on the strength of our balance sheet and expectations for future free cash flow generation.”

“With our strong financial performance, we are able to increase investments to drive long-term growth while returning additional value to our shareholders,” Su added.

About AMD

Based out of California, AMD develops computer processors and related technologies for business and consumer markets.

Shares of the company closed 6.2% higher on Thursday. However, following the share repurchase announcement, after the market closed, the stock slipped 0.9% to end the day at $115.60.

Wall Street’s Take

Recently, Bernstein analyst Stacy Rasgon upgraded the rating on AMD to Buy from Hold with a price target of $150 (28.6% upside potential).

The analyst said, “With the combination of continued stellar execution, increasingly bankable earnings power, and a recent sizable pullback making the valuation downright attractive.”

Overall, the stock has a Moderate Buy consensus rating based on 15 Buys and 8 Holds. The average Advanced Micro Devices price target of $154.28 implies 32.3% upside potential. Shares have gained 41.5% over the past year.

Positive Sentiments

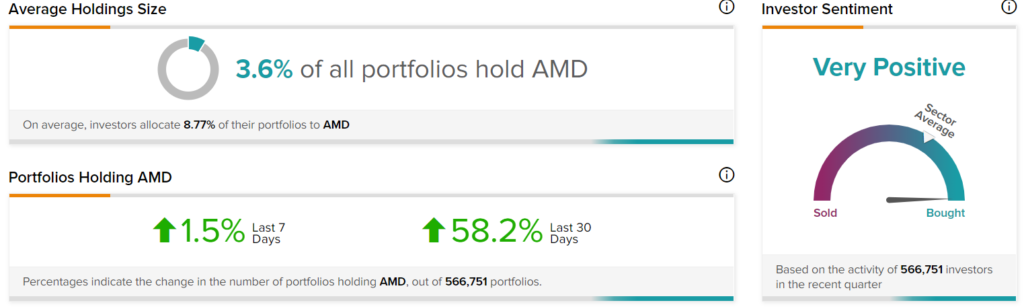

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on AMD, with 58.2% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Quebecor Reports Higher Q4 Profit, Dividend Rises 9%

Arrow Electronics Updates 1 Key New Risk Factor

Lemonade Plunges 22% after Q4 Earnings Miss & Weak Guidance