Due to the recent sell-off in tech stocks, many companies’ price-performance was scathed by investor anxiety. Nevertheless, firms with strong fundamentals and underlying strengths are expected to succeed.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In the ongoing full-fledged earnings season, these companies are likely to reflect strength with strong earnings results and a robust outlook on improving demand sparkling investor optimism.

Advanced Micro Devices (NASDAQ: AMD) was one of them, reporting better-than-expected first-quarter 2022 earnings and robust Q2 revenue guidance. The chipmaker also lifted year-over-year revenue growth expectations for 2022.

Following the update, shares of the company rose 6.77% in the extended trading session on Tuesday.

Interestingly, the first-quarter statistics include partial financial results from the acquisition of Xilinx, which closed on February 14, 2022.

Results in Detail

AMD reported first-quarter adjusted earnings of $1.13 per share, which more than doubled from the prior-year quarter. It also beat analysts’ expectations of $0.91 per share.

Revenue surged 71% to $5.89 billion and topped the consensus estimate of $5.52 billion on the back of double-digit growth across all businesses.

Segmental Revenues

Remarkably, EPYC server processor revenue more than doubled for the third consecutive quarter.

The Computing and Graphics segment’s revenue stood at $2.8 billion, up 33% year-over-year, on the back of higher Ryzen and Radeon processor sales. Additionally, Enterprise, Embedded, and Semi-Custom segment revenue jumped 88% to $2.5 billion driven by elevated EPYC processor, semi-custom, and embedded product sales.

Xilinx’s partial quarter revenue came in at $559 million.

Other Metrics

Adjusted gross margin stood at 53%, up 660 basis points (bps) year-over-year. Additionally, the adjusted operating margin came in at 31%, up 900 bps.

As of March 31, 2022, cash, cash equivalents, and short-term investments were $6.5 billion, while record free cash flow came in at $924 million in the quarter, up from $832 million in the same quarter last year.

During Q1 2022, the company repurchased common stock worth $1.9 billion.

Outlook

During the earnings call, the CEO of AMD, Dr. Lisa Su, said, “Looking forward, we see very strong demand across all of the Xilinx end markets and are focused on increasing supply…We now have the best portfolio of high-performance and adaptive computing engines in the industry, and we see multiple opportunities to leverage our expanded technology portfolio to deliver even stronger products.”

AMD remains on track to launch its next-generation Genoa server processors in the second half of the year and expects consistent market share based on expanded cloud, enterprise, and HPC customer adoption.

For the second quarter of 2022, the company anticipates total revenue in the range of $6.3 billion to $6.7 billion, representing growth of about 69% year-over-year, on the back of the Xilinx acquisition, along with the elevated server, semi-custom, and client revenue. Additionally, the adjusted gross margin is expected to be 54%.

For 2022, AMD now expects revenue of $26.3 billion, up 60% from 2021, compared with the prior guidance of 31%. Additionally, the revised adjusted gross margin is likely to be 54%, up from the prior expectations of 51%.

Wall Street’s Take

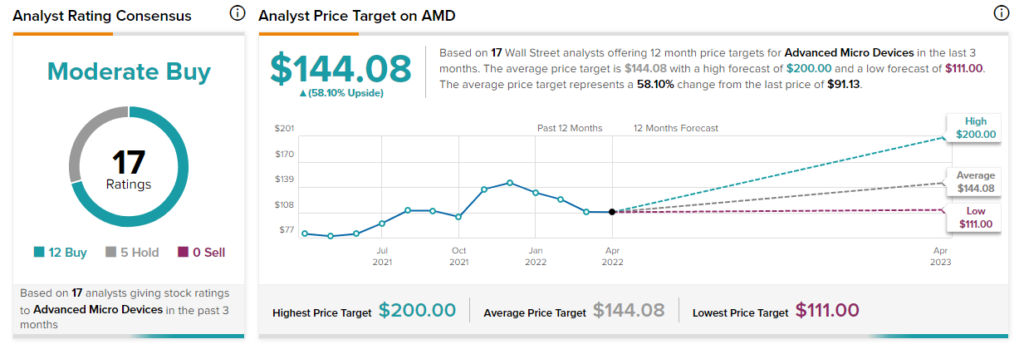

Following the first-quarter earnings results, Rosenblatt Securities analyst Hans Mosesmann reiterated a Buy rating on the stock with a price target of $200 (119.47% upside potential).

Mosesmann believes that the company’s financials are improving consistently, and, therefore maintained a positive stance.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 12 Buys and five Holds. The average Advanced Micro Devices price target of $144.08 implies 58.1% upside potential to current levels. Shares have increased 15.93% over the past year.

Bloggers Weigh In

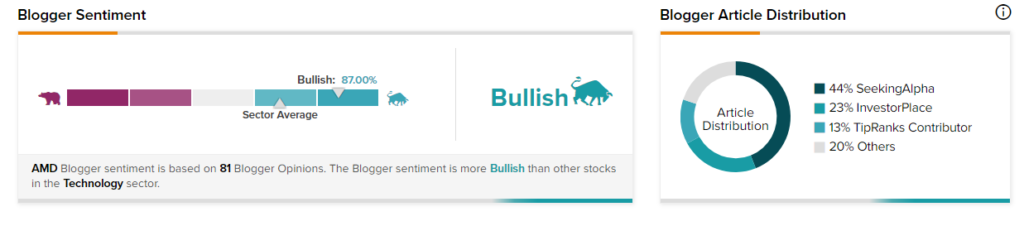

Bloggers seem enthused by the company’s earnings results. TipRanks data shows that financial blogger opinions are 87% Bullish on AMD, compared to a sector average of 68%.

Ending Remarks

With new product launches, recent strategic acquisitions (Xilinx and Pensando), robust earnings, and a strong outlook as decisive factors, investors might consider investing in AMD for significant long-term gains. Additionally, year-to-date price losses of 39.34% seem to have created an attractive entry point for investors.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Devon: Pumping Out Strong Q1 Earnings and Capital Deployment

Spirit Airlines Flies High with Frontier, JetBlue Deal Nosedives

Tesla: Shanghai Production Ratcheted up to 80% Capacity