Viewing history is a valuable thing in streaming. It tells you what you have already seen, and lets streamers know what is most likely to be streamed in the future. But entertainment giant Paramount (PARA) has some troubles on its hands over the viewing history, and a lawsuit followed. Paramount shares are down modestly in the closing minutes of Monday’s trading session.

Word from The Hollywood Reporter revealed that a new class-action lawsuit is in the making over Paramount’s use of viewing history. Apparently, Paramount was handing over copies of users’ viewing history to several social media platforms, including Meta (META) and TikTok. Said platforms then used said information to do exactly what you would think: offer up very targeted ads connected to that viewing history.

Such a move might sound like business as usual, but according to the lawsuit filed in a California federal court by local resident Victor Cho, such a use of streaming history is illegal. It defies the Video Privacy Protection Act, which forbids the revealing of such history. In fact, the Act in question goes back to Supreme Court justice nominee Robert Bork, who found his entire viewing history leaked to a newspaper. The act comes with “…statutory damages of up to $2,500 per class member and carries a private right of action for consumers to sue,” the report noted.

Activist Investor Target?

We all know that some investors have been displeased with the handling of the Skydance merger. In fact, there may well be some other lawsuits to come out of that before it is all said and done. But a Barron’s report noted that activist investors may be targeting Paramount right now. A report from the Securities and Exchange Commission (SEC) revealed that Gamco Investors decreased its stake in Paramount, calling on the company to reconsider the offer for it from Project Rise Partners, which offered $13.5 billion in cash, including $5 billion in debt restructuring.

Meanwhile, other sources are coming out as surprised that the Dungeons & Dragons concept will get no more air time at Paramount. Screen Rant noted that it was a surprise that Paramount was staying out of the market, but it was even more of a surprise to have no other studio step in to pick up the slack. With Dungeons & Dragons a fairly hot commodity among its user base, that should have been an opportunity. Yet somehow, it is not.

Is Paramount Stock a Good Buy Right Now?

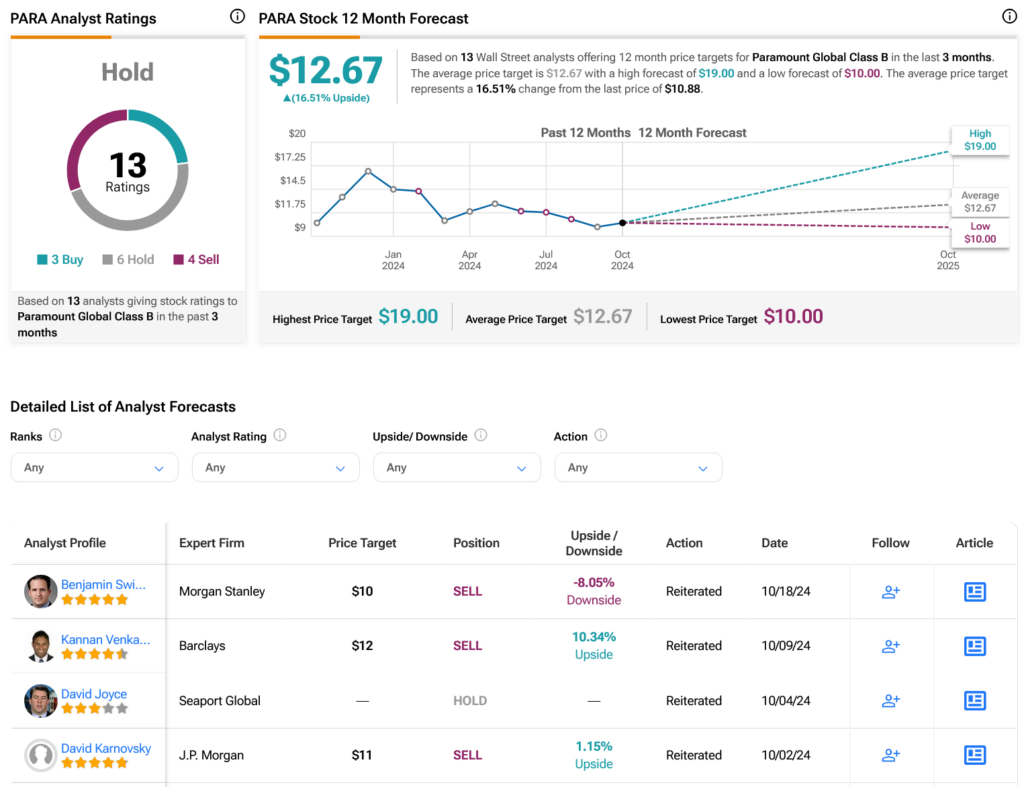

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on three Buys, six Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 12.79% loss in its share price over the past year, the average PARA price target of $12.67 per share implies 16.51% upside potential.