The Seattle-based giant Amazon (AMZN) reported strong third-quarter earnings, beating estimates and driving its stock higher. As a long-term bull, I’m encouraged by Amazon’s ability to sustain growth and margins in AWS, its most profitable segment, coupled with solid progress in other areas, strong cash flow growth, and effective cost management. Additionally, Amazon trades at attractive cash flow multiples relative to its main hyperscaler peers, further supporting its long-term appeal.

In this article, I’ll outline key takeaways from Q3 that make Amazon a compelling investment, not only in the cloud space but also as a diverse business overall.

Amazon’s Q3 Earnings in a Nutshell

My bullish outlook for Amazon’s post-September quarter was reinforced after it reported impressive earnings results. Amazon not only beat expectations across the board but also achieved an 11% year-over-year sales increase to $159 billion, with North American sales up 9% and Amazon Web Services (AWS) sales up 19% year-over-year.

Operating income rose to $17.4 billion on the profitability front, up from $11.2 billion last year, representing roughly 50% growth year-over-year. North America posted $5.7 billion in operating income, while the International segment saw $1.3 billion in operating income—a notable improvement from a loss in the same period last year. AWS achieved $10.4 billion in operating income, compared to $7 billion last year. AWS’s operating income is growing faster than its revenue, indicating expanding margins—a positive sign for Amazon’s overall profitability.

Lastly, Amazon’s guidance was also encouraging. With projected fourth-quarter sales between $181.5 billion and $188.5 billion, reflecting 7% to 11% year-over-year growth, Amazon expects its revenue momentum to continue into the next quarter, setting a strong outlook for the months ahead.

Amazon’s Multifaceted Growth

One of the strongest pillars of Amazon’s bullish thesis is AWS, the company’s highest-margin segment. In this quarter, AWS revenue reached $27.4 billion, up from $23 billion last year, reflecting a $4.4 billion increase year-over-year, with operating margins at a robust 38%. However, Amazon’s growth story extends beyond AWS.

Some of Amazon’s segments, like third-party seller services and advertising, have experienced sequential growth slowdowns over the past four quarters. Advertising growth, for example, declined from 25% to 19%, while third-party seller services growth slowed from 18% to 10%.

Nonetheless, Amazon is a highly diversified company with multiple segments generating tens of billions of dollars in revenue, achieving double-digit growth rates—except for its online stores, which grew at 8%. In fact, Amazon is far more than an online store and AWS; it’s a business with numerous growth drivers across various segments. This diversity, combined with improving profit margins, supports my view that Amazon has significant long-term growth potential, particularly if it continues to enhance its profitability.

Operating Cash Flow and Capital Expenditures

Supporting the favorable outlook, Amazon reported an operating cash flow of $112.7 billion over the last twelve months, marking a 57% increase year-over-year, with free cash flow totaling $47.7 billion. However, it’s important to note that Amazon’s capital expenditures (CapEx) nearly doubled year-over-year in the quarter, reaching $22.6 billion. For the first nine months of the year, CapEx stands at $55.2 billion, up from $38.1 billion last year, and has reached approximately $70 billion in the trailing twelve months.

Like Meta (META), Microsoft (MSFT), and Alphabet (GOOGL), Amazon is heavily investing in expanding its capital expenditures to grow its cloud and AI infrastructure. This trend of skyrocketing CapEx is prominent across the tech giants, which puts pressure on free cash flow.

For this reason, I believe operating cash flow is the best metric to focus on when assessing Amazon’s value relative to its historical performance.

Valuation: The Cheapest Among Hyperscalers

In light of Amazon’s strong progress in generating cash flows, its valuation appears particularly compelling. Amazon trades at a price-to-cash flow multiple of 18.4x, nearly 30% below its five-year historical average. Compared to other hyperscalers like Alphabet and Microsoft, which trade at 20x and 25x, respectively, Amazon is valued at a notable discount despite being the market leader in cloud services.

Given this, I believe it’s fair to say Amazon is the most attractively priced stock among the Big Tech players in the cloud space, especially considering its impressive growth in its highest-margin business.

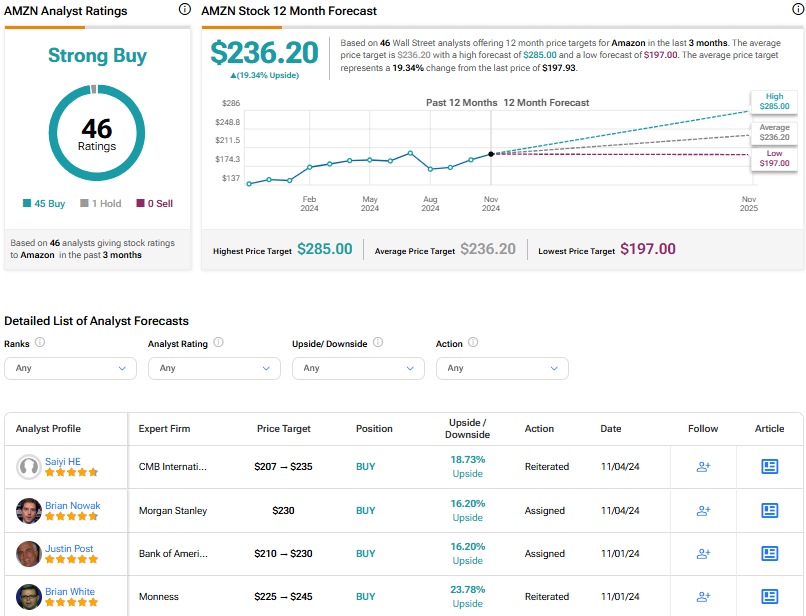

Is AMZN a Buy, According to Wall Street Analysts?

My optimism on Amazon aligns with Wall Street’s positive consensus. On TipRanks, analysts rate Amazon as a Strong Buy, with 45 Buy recommendations and only one Hold. The average price target is $236.20, implying an upside potential of 19.34%.

Conclusion

I rate Amazon as a Buy following its impressive Q3 results. The company demonstrated strong growth across multiple segments, particularly in AWS, which continues to drive revenue and margin expansion.

Additionally, Amazon’s robust cash flow generation and strategic investments in infrastructure underscore its commitment to long-term growth in high-demand areas like cloud and AI. From a profitability perspective—and given the trend of massive investments by hyperscalers—Amazon’s cash flow multiples are trading below its main peers, further supporting the bullish thesis for the Seattle-based giant.