VYM ETF Price & Analysis

VYM ETF Chart & Stats

Day’s Range― - ―

52-Week Range$112.05 - $135.10

Previous Close$122.3

VolumeN/A

Average Volume (3M)1.58M

AUM55.79B

NAV122.26

Expense Ratio0.06%

Holdings Count530

Beta0.77

Inception DateNov 10, 2006

Last Dividend Ex-Date

Mar 21, 2025Dividend Yield

(3.05%)Shares OutstandingN/A

Standard DeviationN/A

10 Day Avg. Volume2,318,763

30 Day Avg. Volume1,578,625

AlphaN/A

ETF Overview

Vanguard High Dividend Yield Index ETF

The Vanguard High Dividend Yield Index ETF (VYM) is a premier investment vehicle designed for those seeking to enhance their portfolio with robust dividend income. As part of the High Dividend Yield category, VYM focuses on delivering a steady stream of income by investing in a diversified array of large-cap U.S. companies known for their strong dividend-paying capabilities. This ETF offers exposure to a broad-based niche market, capturing the performance of high dividend yield stocks across various sectors, thus providing investors with an opportunity to enjoy both income and potential growth. With its strategic emphasis on high dividend yield, VYM is an ideal choice for investors looking to build a resilient, income-generating portfolio while maintaining exposure to a wide spectrum of industries. Managed by Vanguard, known for its low-cost, high-quality investment products, this ETF stands out as a reliable option for those prioritizing dividend income without sacrificing diversification.

Vanguard High Dividend Yield Index ETF (VYM) Fund Flow Chart

Vanguard High Dividend Yield Index ETF (VYM) 1 year Net Flows: $827M

VYM ETF News

PremiumStock Analysis & Ideas

VYM vs. SCHD: Which Is the Better ETF for Dividend Investors?

PremiumStock Analysis & Ideas

VYM: Why I’m Bullish on This Popular Dividend ETF

PremiumStock Analysis & Ideas

SCHD vs. VYM: Which is the Better Dividend ETF?See More VYM News

VYM ETF FAQ

What was VYM’s price range in the past 12 months?

VYM lowest ETF price was $112.05 and its highest was $135.09 in the past 12 months.

What is the AUM of VYM?

As of Apr 14, 2025 The AUM of VYM is 55.79B.

Is VYM overvalued?

According to Wall Street analysts VYM’s price is currently Undervalued.

Does VYM pay dividends?

VYM pays a Quarterly dividend of $0.85 which represents an annual dividend yield of 3.05%. See more information on VYM dividends here

How many shares outstanding does VYM have?

Currently, no data Available

Which hedge fund is a major shareholder of VYM?

Among the largest hedge funds holding VYM’s share is Gunma Bank,Ltd.. It holds VYM’s shares valued at 7M.

VYM ETF Smart Score

Learn more about TipRanks Smart Score

For ETFs, the calculations for the Smart Score, Analyst Consensus, Price Target, Blogger Sentiment, News Sentiment and Insider Transactions are based on the weighted average of the ETF's holdings and some additional factors. Hedge Fund Trend, Crowd Wisdom and Technicals are based on the actual ETF ticker.

Top 10 Holdings

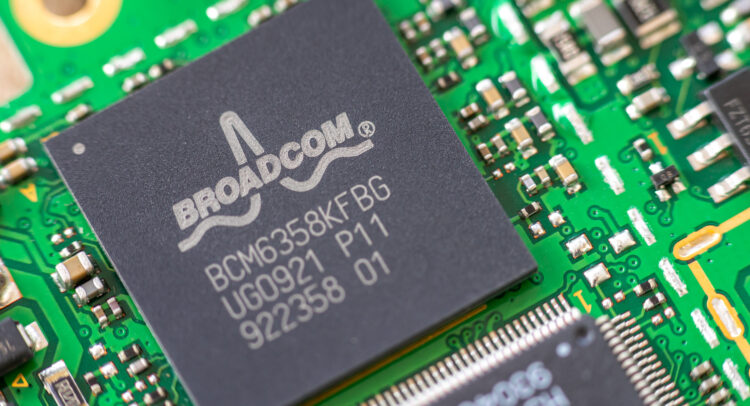

Broadcom Inc.

4.91%

JPMorgan Chase & Co.

4.02%

Exxon Mobil Corp.

2.70%

Walmart Inc.

2.32%

Procter & Gamble Company

2.22%

Johnson & Johnson

2.15%

Home Depot

2.13%

Abbvie

2.00%

Bank of America

1.66%

Coca-cola Company

1.50%

Total25.62%

See All Holdings