Daily Stock Ratings & Price Targets

Analyst Performance

Any

Analyst Rating

Any

Upside / Downside

Any

Action

Any

Market Cap

Any

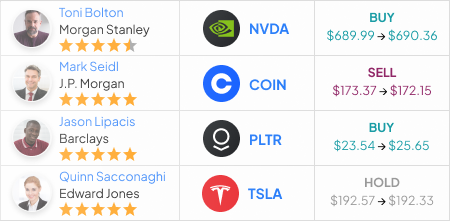

Analyst & Firm | Company | Price | Rating & Price Target | Upside / Downside | Success Rate | Average Return | Action | Date | Article |

|---|---|---|---|---|---|---|---|---|---|

xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $43 | ― | 8.70% | Reiterated | |||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $26.46→$27.34 | ― | 18.60% | Upgraded | |||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $4.9 | ― | 23.10% | Reiterated | |||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $110 | ― | 8.60% | Reiterated | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $5 | ― | 3.50% | Reiterated | |||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $9.5 | ― | 17.50% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $68 | ― | 6.50% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $9 | ― | 3.90% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $77 | ― | 24.10% | Reiterated | ||||

Tanger | BUY $40 | ― | -0.40% | Upgraded | Strong Growth Prospects and Positive Earnings Revisions Justify Buy Rating for Tanger Inc. | ||||

Kilroy Realty | HOLD $42→$36 | ― | -0.40% | Downgraded | Hold Rating on Kilroy Realty Amidst Weaker West Coast Office Demand and Declining FFO Growth | ||||

ARM Holdings PLC ADR | BUY $175→$150 | ― | -1.20% | Reiterated | Analysts Offer Insights on Technology Companies: Robinhood Markets (NASDAQ: HOOD) and ARM Holdings PLC ADR (NASDAQ: ARM) | ||||

TSMC | BUY $255 | ― | -0.40% | Reiterated | New Buy Rating for TSMC (TSM), the Technology Giant | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $38→$40 | ― | 8.70% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $120 | ― | 9.80% | Initiated | ||||

Oxford Industries | HOLD | ― | -10.30% | Downgraded | Oxford Industries downgraded to Sector Weight from Overweight at KeyBanc | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $320 | ― | 2.10% | Reiterated | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $114 | ― | 4.40% | Reiterated | |||||

nCino | BUY $44→$40 | ― | -14.20% | Reiterated | KBW Reaffirms Their Buy Rating on nCino (NCNO) | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $118→$120 | ― | 15.30% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $245→$275 | ― | 10.70% | Upgraded | ||||

Getty Realty | HOLD $32 | ― | -0.40% | Initiated | UBS starts Getty Realty (GTY) at NeutralUBS analyst Michael Goldsmith initiates coverage on Getty Realty (NYSE: GTY) with a Neutral rating and a price target of $32.00. | ||||

American Public Education | BUY $28 | ― | -10.50% | Reiterated | American Public Education transferred with Buy rating at B. Riley | ||||

Lincoln Edu | BUY $23 | ― | -10.50% | Reiterated | Lincoln Educational transferred with Buy rating at B. Riley | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $20→$14 | ― | 3.50% | Downgraded | |||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $16→$9 | ― | 3.50% | Downgraded | |||||

Universal Technical Institute | BUY $31 | ― | -10.50% | Reiterated | Universal Technical transferred with Buy rating at B. Riley | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $4→$5 | ― | 0.60% | Upgraded | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $80 | ― | 2.10% | Reiterated | ||||

Perimeter Solutions | BUY $18 | ― | -5.80% | Reiterated | Strong Market Position and Growth Potential Make Perimeter Solutions a Compelling Buy | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $4 | ― | 0.20% | Reiterated | |||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $46 | ― | 5.10% | Reiterated | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $90 | ― | 5.60% | Reiterated | |||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $25→$23 | ― | 5.50% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $34 | ― | 13.00% | Upgraded | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $29→$27 | ― | 1.30% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $495→$435 | ― | 13.00% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $420→$360 | ― | 13.00% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $290→$250 | ― | 13.00% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $195→$175 | ― | 13.00% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | SELL $165→$140 | ― | 13.00% | Reiterated | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $80→$65 | ― | 13.00% | Reiterated | ||||

Worthington Industries | HOLD $49→$54 | ― | -3.40% | Reiterated | Worthington price target raised to $54 from $49 at Canaccord | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $40→$42 | ― | 3.20% | Reiterated | |||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $20 | ― | 13.00% | Upgraded | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | SELL | ― | 13.00% | Downgraded | ||||

xxxxxxxxxxxxxxxxxx xxxxxxxxxxxxxxxxxx | xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $3 | ― | 10.80% | Reiterated | ||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | HOLD $310 | ― | 3.50% | Reiterated | |||||

xxxxxxxxxxxxxxxxxxxxxxxxxxx | BUY $77→$75 | ― | 8.90% | Reiterated | |||||

Ashland | BUY $80→$69 | ― | 0.00% | Reiterated | Ashland (ASH) Gets a Buy from Wells Fargo |

Rows: