Shares of Zynga, Inc. (ZNGA) tanked 15.8% in the extended trading session on Thursday after the mobile games developer reported lower-than-expected Q2 earnings.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Q2 revenues soared 59% year-on-year to $720 million and surpassed the consensus mark of $713 million. The top line was supported by 51% year-over-year growth in revenues from online games and more than double advertising income.

Earnings came in at $0.02 per share against a loss of $0.16 per share in the year-ago quarter. However, it lagged the Street’s estimates of $0.09.

The company reported average mobile daily active users (DAUs) of 41 million in Q2, up 87% year-over-year. Also, the average mobile monthly active users (MAUs) of 205 million increased 194%. The growth can be attributed to addition of Rollic’s hyper-casual portfolio, Toon Blast and Toy Blast. (See Zynga stock charts on TipRanks)

The CEO of Zynga, Frank Gibeau, said, “Our multi-year strategy of growing our live services, launching new games and investing in global expansion continues to position Zynga for growth.”

Q3 & FY 2021 Guidance Raised

In Q3, Zynga expects to report $665 million in revenues, up 32% year-over-year, with bookings of $660 million, up 5% year-over-year.

In 2021, the company expects to deliver $2.73 billion in revenue, up 38% year-over-year. Bookings are anticipated to rise 23% year-over-year to $2.8 billion.

Zynga expects to generate a net loss of $135 million in 2021, which includes a charge of $84 million primarily related to the impairment of its existing San Francisco lease and related leasehold improvements.

StarLark Buyout

Alongside earnings, the company announced that it has signed an agreement to acquire StarLark in a cash and stock deal worth $525 million. The deal is expected to close in the fourth quarter of 2021.

China-based StarLark is the developer of Golf Rival, a fast-growing mobile game. With this deal, Zynga’s international presence is expected to get a boost.

Analysts Remain Bullish

On August 2, Wedbush analyst Michael Pachter reiterated a Buy rating on the stock with a price target of $15 (upside potential of 53.5%).

Pachter noted, “Ongoing live services and advertising bookings momentum, the launches of high-profile games over the next several quarters, greater penetration of overseas markets, and the unlocking of Chartboost-related synergies position the company for sustained growth.”

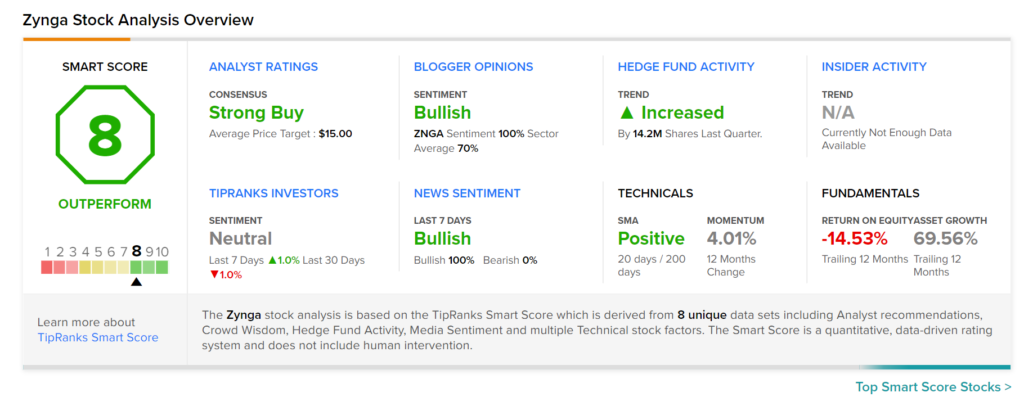

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average Zynga price target stands at $15 and implies upside potential of 53.5%.

ZNGA scores an 8 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Related News:

Amarin Q2 Earnings, Revenues Surpass Estimates

Ping Identity Stock Jumps 15% on Solid Q2 Results

MetLife Posts Strong Q2 Results; Approves $3B Share Buyback Plan