Shares of Zuora slipped about 3.5% on Friday after the software company forecasted a 4Q loss that could be in line with or wider than the Street’s estimates. Against this, the company posted better-than-expected 3Q results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Zuora’s (ZUO) third-quarter adjusted loss narrowed to $0.01 per share, from a loss of $0.06 in the year-ago period and beat analysts’ estimates for a loss of $0.05 per share. Revenue in the reported quarter increased 8% year-over-year to $77.2 million and topped the Street’s consensus of $73.9 million. The company’s subscription revenue jumped 15% year-over-year to $62 million in 3Q.

Zuora’s CEO Tien Tzuo said, “Our enterprise go-to-market initiatives are gaining traction, helping us land the largest deal in the company’s history. The demand for subscription business models remains strong and we have strengthened the foundation for Zuora to continue to lead the market.”

As for 4Q, the company expects revenues to generate between $75 million to $77 million, exceeding the consensus estimates of $74.3 million. However, Zuora anticipates its 4Q loss to be in the range of $0.05 to $0.06 per share, compared to analysts’ expectations of a loss of $0.05.

For fiscal 2021, Zuora expects revenues to range between $301.1 million to $303.1 million with a loss range of $0.13 to $0.14 per share. (See ZUO stock analysis on TipRanks).

Following the results, Needham analyst Scott Berg said, “Zuora reported 3Q financial results and metrics that were notably ahead of our estimates.” He added, “The company also reported its first ever breakeven operating income quarter benefiting from improved revenue mix and better OpEx cost controls.” However, Berg said that “one quarter of improved execution is not a trend,” and maintained his Hold rating on the stock.

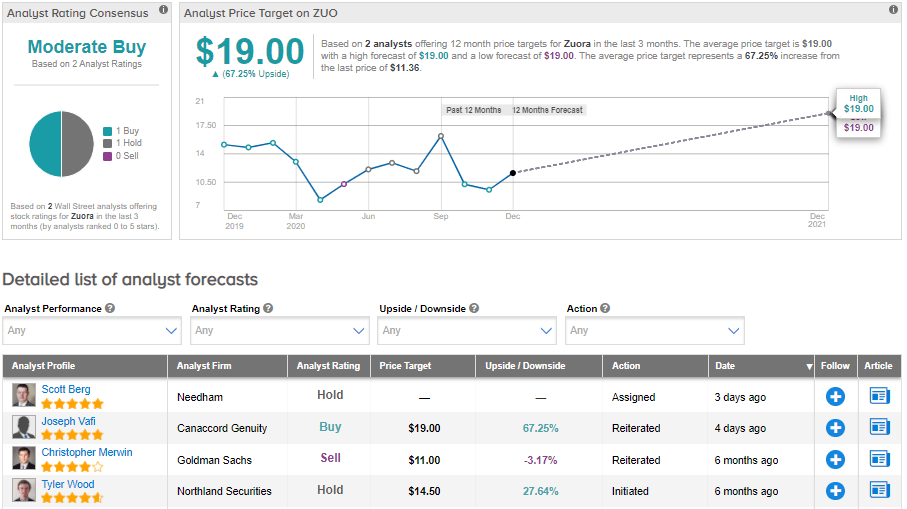

The stock scores a Moderate Buy analyst consensus based on two recent ratings in the past 3 months. The price target stands at $19 and implies upside potential of about 67.3% to current levels. Shares have declined by 20.7% year-to-date.

Related News:

PagerDuty Pops 26% On Raised 2021 Sales Outlook; Monness Lifts PT

Salesforce Crushes 3Q Estimates; Shares Slip 4.8%

Okta Jumps 9% As Cloud Demand Boosts Sales; Analyst Lifts PT