Shares in Zogenix (ZGNX) rallied 7% in Thursday’s after-hours trading after the company shared new data for Fintepla (fenfluramine) oral solution in Dravet syndrome at the Child Neurology Congress 2020.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Dravet syndrome is a rare, highly refractory form of infant- and childhood-onset epilepsy marked by frequent and often prolonged seizures that are difficult to control with existing medications, significant cognitive and motor impairments, and a higher risk of sudden death.

Efficacy was assessed as the reduction in monthly convulsive seizure frequency (MCSF) from core study baseline. Patients experienced a clinically meaningful and statistically significant reduction in MCSF over the entire treatment period of two years (-63%).

“In addition to the significant convulsive seizure reductions seen in all three multi-national Phase 3 studies of FINTEPLA in Dravet syndrome, we are proud to collaborate with expert clinician investigators to show the durability of the clinically meaningful seizure reduction that FINTEPLA provided for patients treated for up to two years,” said Bradley S. Galer, Chief Medical Officer at Zogenix.

Furthermore, new post-hoc data analysis demonstrated that for every two to three patients treated with Fintepla, one patient achieved ≥75% (profound) convulsive seizure reduction compared with placebo.

“We believe these new data analyses further showcase the clinical value that FINTEPLA provides for many Dravet syndrome patients and their families” stated Galer.

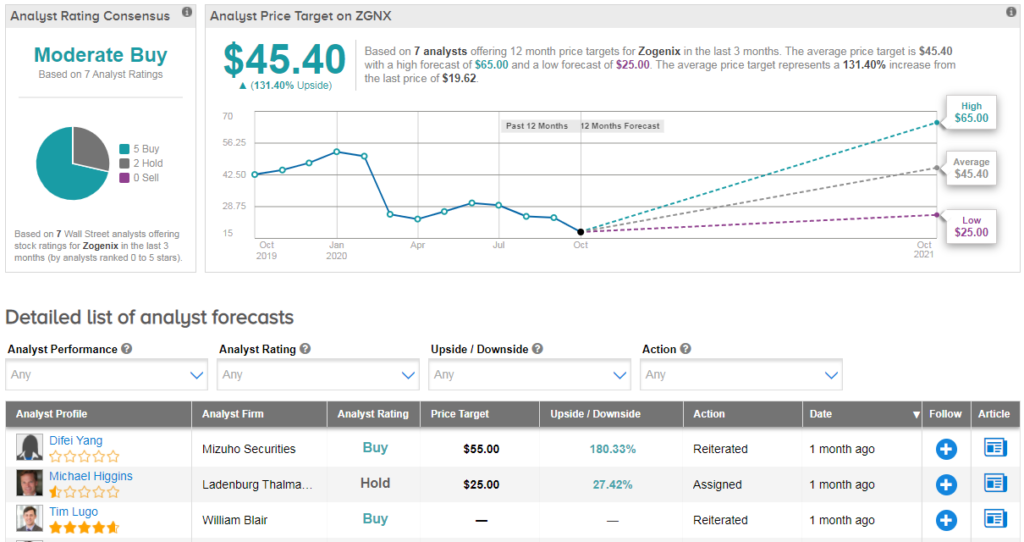

Shares in ZGNX have plunged over 60% year-to-date, but analysts have a cautiously optimistic Moderate Buy consensus on the stock’s outlook. That’s with an average analyst price target of $45- indicating shares can more than double from current levels.

“We continue to believe in Fintepla’s long-term potential to be the standard of care for Dravet Syndrome, particularly following promising early launch indicators” comments Mizuho Securities analyst Difei Yang. She has a buy rating on Zogenix and $55 price target.

She sees upside in ZGNX shares driven by Fintepla in Dravet, an area of high unmet medical need and from additional pipeline indications including Lennox–Gastaut syndrome; adding that the firm’s revenue estimates of $4.2mil/$45.7mil for 2020/2021 are achievable with potential upside. (See Zogenix stock analysis on TipRanks)

Related News:

Vertex Sinks 12% On Halt of VX-814 Development; Merrill Lynch Says Buy

J&J Halts Covid-19 Vaccine Trial Due To ‘Unexplained Illness’

Amarin Pops 4% After-Hours On Positive PCI Data For Vascepa