Zions Bancorporation delivered 3Q EPS of $1.01, which was higher than analysts’ estimate of $0.88. Its revenues of $712 million beat the Street consensus by $3.67 million. The bank holding company’s shares are up 1.9% in Tuesday’s pre-market session.

Zions (ZION) reported 3Q net interest income of $555 million, lower than the $567 million generated in the year-ago quarter. Net interest margin was 3.06% compared with 3.48% in the year-ago quarter. Provisions for credit losses ballooned to $55 million versus the $10 million a year-ago due to economic headwinds caused by COVID-19. The company’s 3Q efficiency ratio of 62.2% also increased from the year-ago quarter’s 57.3%. Excluding the $30 million charitable contributions, the efficiency ratio was 58%.

Zions CEO Harris H. Simmons said “Approximately 9% of our borrowers availed themselves of loan modifications or short-term deferrals earlier this year, with 88% of deferred loans having completed the deferral period before August 1. At quarter-end, a mere 1% of those loans were delinquent 30 days or more, with an additional 0.2% having been charged off. Additionally, annualized net charge-offs for the entire loan portfolio were a very manageable 0.38%.” (See ZION stock analysis on TipRanks).

Ahead of 3Q earnings, on Sept. 29, Truist Financial analyst Jennifer Demba raised the stock’s price target to $44 (45.6% upside potential) from $40 and maintained a Hold rating on the stock. Demba said that she expects lower net-charge-offs to drive 3Q earnings beat. However, net interest margin pressure would remain. The analyst added that improvement in customer fees and strong mortgage fees could drive further upside in the stock.

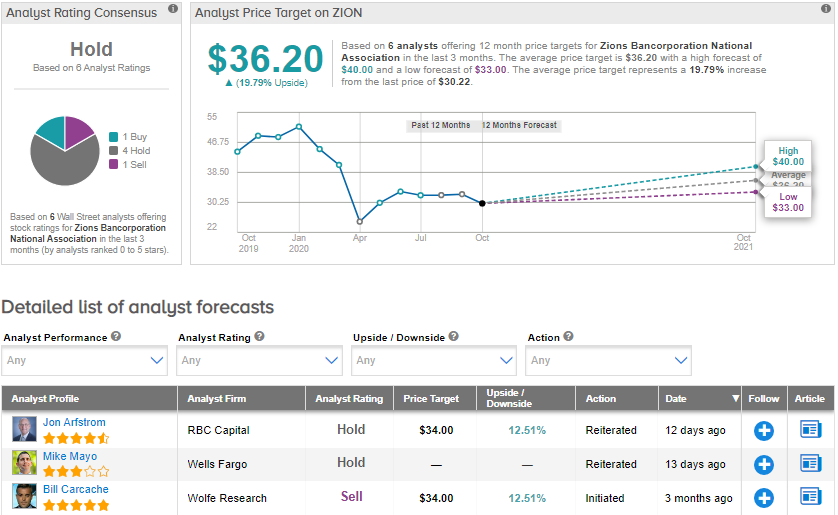

Currently, the Street is sidelined on the stock. The Hold analyst consensus is based on 4 Holds, 1 Buy and 1 Sell. The average price target of $36.20 implies upside potential of about 19.8% to current levels. Shares have declined by 41.8% year-to-date.

Related News:

Logitech Ramps Up 2021 Outlook As 2Q Sales Pop 75%

IBM Posts Third Quarterly Sales Drop In a Row; Shares Fall

Hexcel Drops 8% As Covid-19 Headwinds Trigger 3Q Loss

Questions or Comments about the article? Write to editor@tipranks.com