Shares of container line shipping company ZIM Integrated Shipping Services (NYSE:ZIM) tanked nearly 11% in the opening session today. This came after its third-quarter results fell short of expectations, and its outlook disappointed investors.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

During the quarter, revenue declined by nearly 61% year-over-year to $1.27 billion. The figure lagged expectations by $20 million. Moreover, EPS of -$18.90 missed the mark by a wide margin of $17.17. In comparison, ZIM generated an EPS of $9.66 in the year-ago quarter.

While the company’s carried volume increased slightly to 867,000 TEUs, the average freight rate per TEU during the quarter plummeted by 66% year-over-year to $1,139. In addition, due to weak demand and deteriorating freight rates, ZIM recorded a non-cash impairment charge of nearly $2.1 billion and moderated its outlook for the full year.

For Fiscal Year 2023, the company now expects adjusted EBITDA to be between $900 million and $1,100 million and anticipates its adjusted EBIT to be in the range of -$600 million to -$400 million. In comparison, it had earlier anticipated adjusted EBITDA to be between $1.2 billion and $1.6 billion, and its adjusted EBIT to be in the range of -$500 million to -$100 million.

The company had $3.1 billion in total liquidity at the end of the quarter. In the current challenging environment, ZIM has initiated cost reduction measures and skipped announcing a dividend for shareholders. ZIM’s last dividend announcement of $6.4 per share came in April 2023.

What is the Price Target for ZIM Stock?

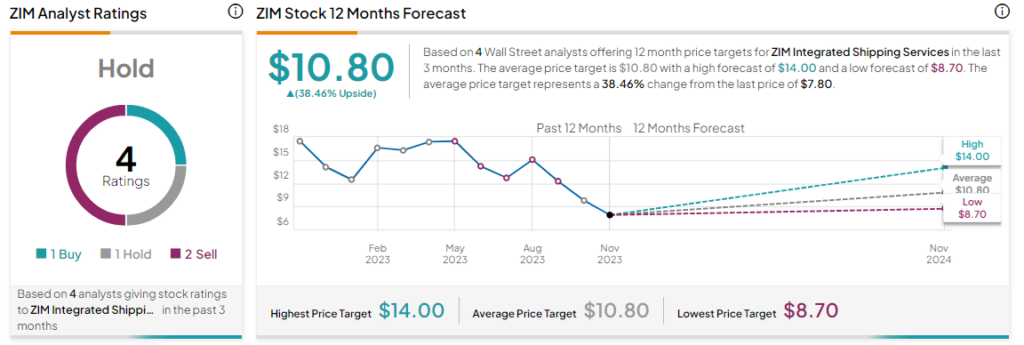

Overall, the Street has a Hold consensus rating on ZIM Integrated Shipping. Following a nearly 70% nosedive in the company’s shares over the past year, the average ZIM price target of $10.80 implies a substantial 38.5% potential upside in the stock.

Read full Disclosure