Online real estate marketplace Zillow Group (Z) is adding data on climate change risks to its home listings as damage caused by severe weather, and insurance claims, continue to grow.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Each home listed for sale on Zillow’s platform now displays climate risk scores for flood, fire, wind, air, and heat. The site also includes recommendations as to whether homeowners should have flood insurance on a property. Flood risks are a growing area of concern for homeowners and insurance companies because of intensifying rainfalls and storms in many areas.

Zillow says it’s adding the climate risk data in response to customer demands. The company says a survey it conducted found that more than 80% of homebuyers now consider climate risks when purchasing a home. Respondents named “flood risk” as their biggest worry, followed by “fire.”

Putting a Price on Climate Change

Climate change, and its impacts, are growing around the world, impacting homeowners. Zillow says more homes nationwide in the U.S. have a major climate risk than they did five years ago. Among new listings on Zillow’s site in August this year, 16.7% were at major risk for wildfire and 12.8% were at risk of flooding.

News of Zillow’s new climate risk scores comes in the aftermath of Hurricane Helene, whose insured losses are estimated at more than $6 billion. The cost of insurance is already factored into home prices, says Zillow. But home insurance costs are likely to rise in coming years as a growing number of properties find themselves at risk from severe weather caused by climate change.

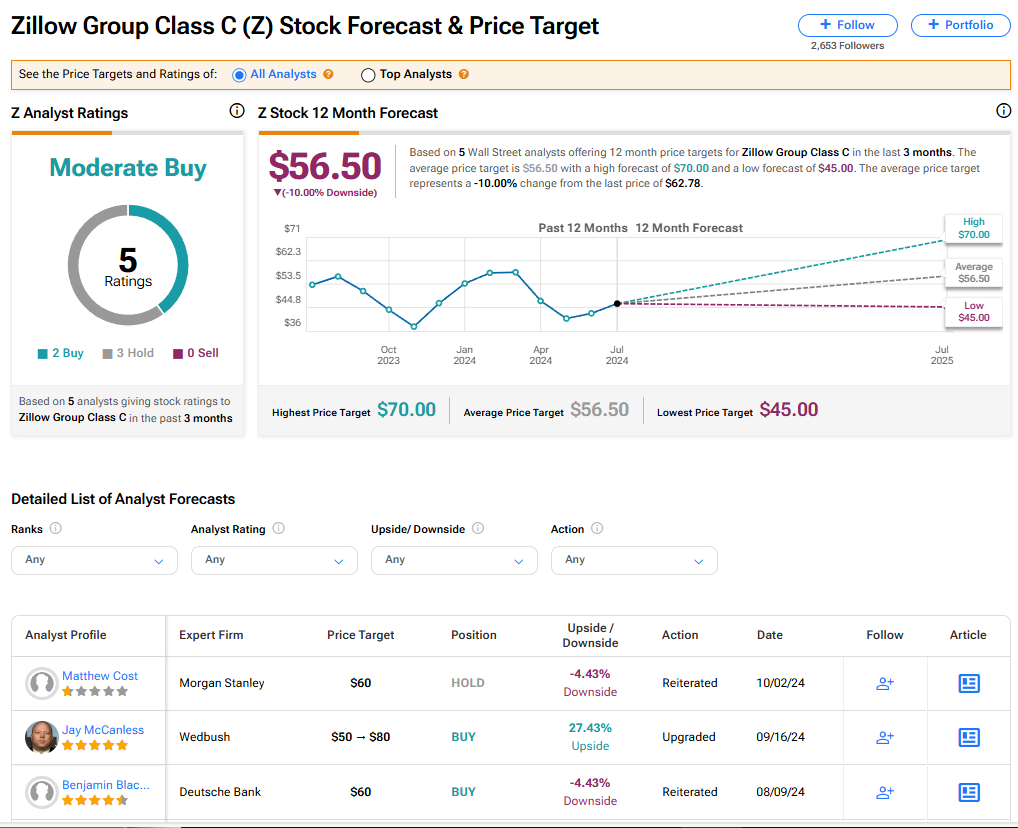

Is Z Stock a Buy?

The stock of Zillow Group has a consensus Moderate Buy rating among five Wall Street analysts. That rating is based on two Buy and three Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average Z price target of $56.50 implies 10% downside risk from current levels.