Zendesk, Inc. (NYSE: ZEN), a customer-service platform, revealed the termination of its merger agreement with Momentive Global Inc. (NASDAQ: MNTV), the parent company of the online survey platform SurveyMonkey.

Shares of Zendesk remains almost flat in the extended trading session on Friday, while shares of Momentive lost 2.4%.

The all-in stock merger deal, announced in October, was terminated following Zendesk’s shareholders’ rejection of the deal at a stockholder meeting despite Momentive shareholders’ approval. The companies aimed to create a powerful new Customer Intelligence company through the combined entity.

Official Comments

Zendesk CEO Mikkel Svane said, “While we were excited by the potential of this transaction to transform the customer experience and create stockholder value, we respect and appreciate the perspectives of our stockholders.”

“Our Board and management team remain laser-focused on our strategy and execution. Zendesk’s business has never been stronger, with accelerated revenue growth of 30% to $1.34 billion in revenue in 2021 and a clear path to generating $3.4 billion in revenue by 2025,” added Svane.

Momentive CEO Zander Lurie said, “While we are disappointed that Zendesk stockholders did not vote to approve the transaction, we are confident in our go-forward strategy.”

Earnings Recap

Earlier this month, for the fourth quarter of 2021, Zendesk reported disappointing earnings of $0.16 per share, which came in below the consensus estimate of $0.18 per share but grew 45.5% year-over-year. Meanwhile, total revenue of $375.4 million grew 32.4% and topped analysts’ expectations of $369.83 million.

For Q1 2022, the company expects revenue in the range of $381-$387 million versus the consensus estimate of $383 million. For 2022, revenue is forecast between $1.675 billion and $1.705 billion, compared with analysts’ expectations of $1.69 billion.

Analyst’s Recommendation

Following the fourth-quarter results, Piper Sandler analyst Brent Bracelin maintained a Hold rating on Zendesk but lifted the price target to $135 (16.9% upside potential) from $112.

Despite the “litany of distractions” during the fourth quarter and employee turnover, Bracelin considers the core Zendesk service cloud performance to be impressive.

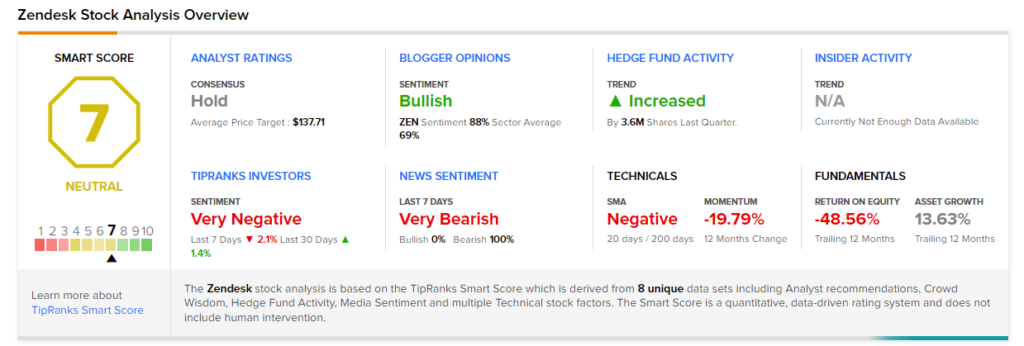

Overall, the stock has a Hold consensus rating based on 2 Buys and 7 Holds. The average Zendesk price target of $137.71 implies 19.25% upside potential. Shares have lost 23.3% over the past year.

Smart Score

According to TipRanks’ Smart Score system, Zendesk gets a 7 out of 10, which indicates that Zendesk stock is likely to perform in line with market averages.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Coinbase Falls 5.8% Despite Strong Q4 Earnings

Zscaler Plunges 15% Despite Q2 Beat

Moderna Soars 15% on Stellar Q4 Results