AI search company Yext, Inc. (YEXT) provides an Answers Platform, which understands natural language and helps consumers get answers about Yext’s enterprise customers.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Recently, YEXT posted better-than-expected performance for the third quarter, with its top-line and bottom-line exceeding analysts’ estimates.

Q3 revenue increased 11.7% year-over-year to $99.5 million, exceeding estimates by $1.3 million. Net loss per share at $0.04 beat estimates by $0.03. Furthermore, Yext’s remaining performance obligations stood at $337 million at the end of October.

Looking ahead, Yext forecasts Q4 revenue to be between $100 million and $102 million. Net loss per share is expected to hover between $0.08 and $0.10.

With these developments in mind, let us take a look at the changes in Yext’s key risk factors that investors should know.

Risk Factors

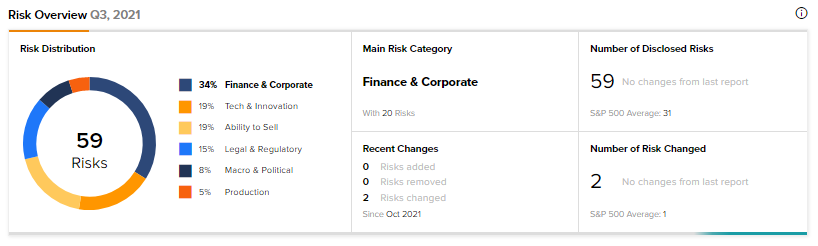

According to the TipRanks Risk Factors tool, Yext’s top risk category is Finance & Corporate, contributing 34% to the total 59 risks identified. In its recent quarterly report, the company has changed two key risk factors.

Under the Finance & Corporate risk category, Yext highlighted that its credit facility contains restrictive covenants, which may limit its operational flexibility. Consequently, it may also limit Yext’s ability to transfer or dispose of assets, make acquisitions, pay dividends, incur additional debt, enter into new businesses or mergers.

Furthermore, there is no guarantee if Yext would be able to generate sufficient cash flow or sales to satisfy its financial covenants, or pay principal and interest on the debt.

Under the Ability to Sell risk category, Yext acknowledged that its revenue growth hinges substantially on its sales force as much of its sales process is relationship-driven. Although Yext plans to expand and scale its direct sales force, in the past, it has had difficulty recruiting and retaining a sufficient number of sales personnel.

(See Insiders’ Hot Stocks on TipRanks)

Any failure to expand and scale its sales force could mean that Yext may not be able to reach its market potential or carry out its business plan.

Compared to a sector average of 14%, Yext’s Ability to Sell risk factor is at 19%.

Wall Street’s Take

Consensus on the Street is a Moderate Buy based on a Buy, and Hold each for the stock. The average Yext price target of $18 implies a potential upside of 69.6% for the stock. That’s after a 10.1% drop in Yext’s share price over the past month.

Related News:

ConocoPhillips Streamlines Global Portfolio, Announces Two Deals

Citi Halts Share Buyback Amid New Regulation

Amazon Faces $1.28B Fine in Italy — Report