Yeti Holdings, Inc. (YETI) has reported better-than-expected third-quarter results, aided by solid demand for both its Drinkware and Coolers & Equipment segments.

Despite robust results, shares of the global designer, retailer and distributor of innovative outdoor products fell 6.5% to close at $96.61 on November 11.

Better-Than-Expected Results

Yeti’s adjusted earnings rose 5% year-over-year to $0.64 per share and surpassed analysts’ estimate of $0.59 per share. According to the company, the current inflationary environment helped the company gain higher per-share earnings.

Furthermore, net sales rose 23% year-over-year to $362.64 million, beating the Street’s estimate of $356.74 million. Compared to the third quarter of FY20, while net sales for the Drinkware segment grew 24%, net sales for Coolers & Equipment jumped 20%.

See Analysts’ Top Stocks on TipRanks >>

Management Comments

Matt Reintjes, the President and CEO of Yeti, said, “We are focused on building on the strong momentum in our business through the holidays and well into the future. While we are not immune to the confluence of supply chain disruptions and cost pressures that are pervasive in the market, our team’s ongoing execution has supported our ability to once again raise both our top and bottom-line outlooks for the year.”

Updated Guidance

Based on the continued business momentum, Yeti has increased its full-year fiscal 2021 outlook. Net sales are expected in the range of $1.39 billion to $1.41 billion. Similarly, adjusted earnings are expected between $2.51 per share and $2.53 per share, higher than the consensus estimate of $2.48 per share.

Analyst’s Take

Responding to Yeti’s quarterly performance, Berenberg Bank analyst Rudy Yang, said, “Demand remained robust across drinkware, coolers, and equipment products, leading to continued growth for both the company’s DTC and wholesale channels. Additionally, despite facing pressures related to its supply chain and elevated costs similar to many other product manufacturers, Yeti noted it expects to see a slight year-over-year improvement in adj. operating margins for FY2021.”

The analyst concluded, “While Yeti’s solid results highlight the continually growing strength of its branding power, we struggle to find much upside at the current valuation.”

Yang has reiterated a Hold rating on the stock with a price target of $103, which implies 6.6% upside potential to current levels.

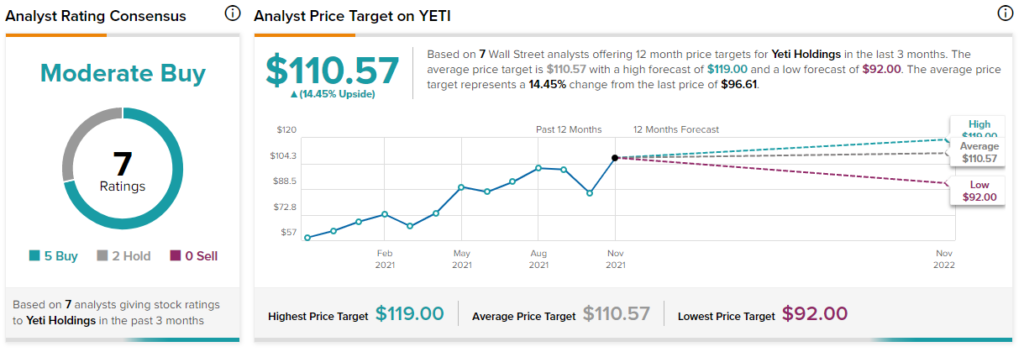

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 2 Holds. The average Yeti price target of $110.57 implies 14.45% upside potential to current levels. Shares have gained 73.6% over the past year.

Related News:

ContextLogic Down 4.3% Despite Q3 Beat

Monday.com Plunges 21% Despite Outstanding Q3 Results

Hershey to Buy Two Pretzel Brands for $1.2B