XPO Logistics (NYSE:XPO) shares soared over 15% yesterday following the release of better-than-expected third-quarter results. The freight transportation company’s quarterly performance benefited from solid volumes, higher pricing, and improved labor productivity.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company’s earnings stood at $0.88 per share, down 7.4% from the same quarter last year. The figure, however, topped the analysts’ expectations of $0.64 per share. Meanwhile, XPO reported Q3 revenues of $1.98 billion, up 1.5% year-over-year and surpassing the consensus estimate of $1.93 billion.

Segment-wise, revenue from the North American Less-Than-Truckload (LTL) unit was $1.23 billion, up 1.9% year-over-year. Further, shipments per day rose 7.8%, tonnage per day increased by 3.1%, and yield (excluding fuel) was up 6.4%. The European Transportation division witnessed a 1.5% growth in revenue to $752 million.

Promising Prospects Ahead

At the company’s Q3 earnings call, CEO Mario Harik said he sees a double-digit pricing opportunity in the coming years, which should help drive revenue growth.

Moreover, XPO anticipates that the increased value-added services, such as retail store rollouts and grocery consolidations, as well as a stronger emphasis on local customers that yield higher margins, will contribute to its pricing efforts in the future.

Is XPO a Good Stock to Buy?

It is worth mentioning that post-Q3 earnings release, two analysts rated the stock a Buy. Among these, TD Cowen analyst Jason Seidl expects XPO to increase its long-term margin targets for the LTL unit going forward. Also, he believes that the company can benefit from the bankruptcy of its rival, Yellow, while continuing to improve its services.

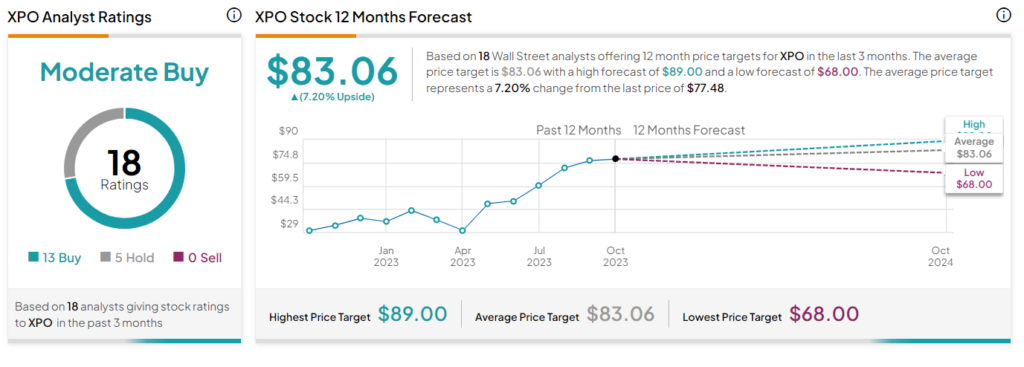

Overall, Wall Street analysts are cautiously optimistic about XPO stock. It has a Moderate Buy consensus rating based on 13 Buys and five Holds. The average XPO stock price target of $83.06 implies a 7.2% upside potential.