XPeng Inc. (XPEV) has delivered impressive fourth quarter results on the back of record vehicle deliveries during the quarter. The company engages in designing, developing, manufacturing, and marketing smart electric vehicles primarily in China.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Results in Detail

Total revenue grew 200.1% year-over-year to $1.34 billion, surpassing the consensus estimate of $1.12 billion. Income from vehicle sales stood at $1.28 billion, up 199.3%.

Furthermore, adjusted quarterly loss stood at $0.22 per American Depositary Shares (ADS), lower than the Street’s loss estimate of $0.28 per ADS.

During the quarter, the company delivered 41,751 vehicles, an increase of 222% year-over-year. The delivery of its P7 smart sports sedans soared to 21,342 units. Also, as of December 31, 2021, its supercharging stations stood at 772, covering 308 cities across China.

For 2021, XPeng has reported revenue of $3.29 billion, up 259.1% year-over-year. Also, adjusted quarterly loss stood at $0.86 per ADS. The company delivered a total of 98,155 vehicles in 2021, up 263% from 27,041 in 2020.

Management Comments

The Vice-Chairman and President of XPeng, Dr. Hongdi Brian Gu, said, “Fueled by our strong vehicle models on the market, planned new launches based on new platforms, and technology leadership, we are confident in our continued growth trajectory and structural improvement of gross margin.”

Outlook

Based on the continued business momentum and current market conditions, XPeng expects first-quarter vehicle deliveries between 33,500 and 34,000. Meanwhile, revenue is expected to grow in the range of 144%-147.4%, compared to the year-ago quarter.

Price Target

Following the results, US Tiger Securities analyst Bo Pei CFA upgraded XPeng’s rating to Buy from Hold but lowered the price target to $43 from $50. The new price target implies 58.5% upside potential from current levels.

According to the analyst, the current valuation of the stock is “attractive and presents a level where supply chain risk is already price in.”

With seven unanimous Buys, the XPEV stock commands a Strong Buy consensus rating. XPeng’s average price target of $42.55, implies 56.8% upside potential to current levels. Shares have tanked 46% year-to-date.

Blogger Opinion

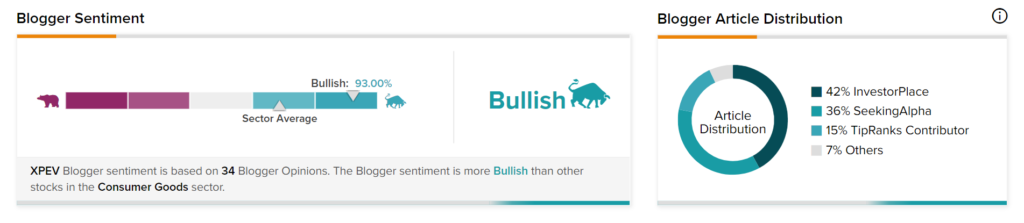

TipRanks data shows that financial blogger opinions are 93% Bullish on XPEV, compared to the sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Victoria’s Secret Rises 3.2% on Securing Minority Stake in Frankies Bikinis

Exela’s Strategic Investment in UBERDOC to Expand its Digital Healthcare Footprint

Axsome Rises 2.1% on Acquisition of Sunosi from Jazz Pharmaceuticals