Smart electric vehicles producer XPeng Inc. (NYSE: XPEV) has reported mixed results for the first quarter ended March 31, 2022.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the news, shares of the company declined more than 7% to close at $21.58 in Monday’s extended trading session.

Revenue & Earnings

XPeng reported revenues of $1.2 billion, up 152.6% year-over-year, topping the consensus estimate of $1.1 billion.

The company reported a loss of $0.28 per share, wider than the loss of $0.14 per share reported in the year-ago quarter. The figure, however, came in line with the consensus loss estimate of $0.28 per share.

Other Key Metrics

In the first quarter of 2022, the company delivered 34,561 vehicles, up 159% year-over-year. Its charging stations at the end of the quarter stood at 933, including 757 XPeng self-operated supercharging stations and 176 destination charging stations.

Further, XPeng’s physical sales network stood at 366 stores across 138 cities. Its gross margin improved from 11.2% in the previous year to 12.2% in the first quarter of 2022.

Management’s Take

The CEO of XPeng, He Xiaopeng, said, “Our first quarter performance marked a strong start to 2022. Demand for our high-quality EV products was robust and our proprietary suite of technologies continue to lead the industry. Superior in-house technology development capability and proactive supply chain management enabled us to address supply chain challenges more efficiently. We remain confident in expanding our market share despite the impact of semi-conductor shortage and COVID-19.”

Stock Rating

Overall, the stock has a Strong Buy consensus rating based on nine Buys and one Hold. XPEV’s average price target of $45.16 implies upside potential of 105.5% from current levels. Shares have declined 24.6% over the past year.

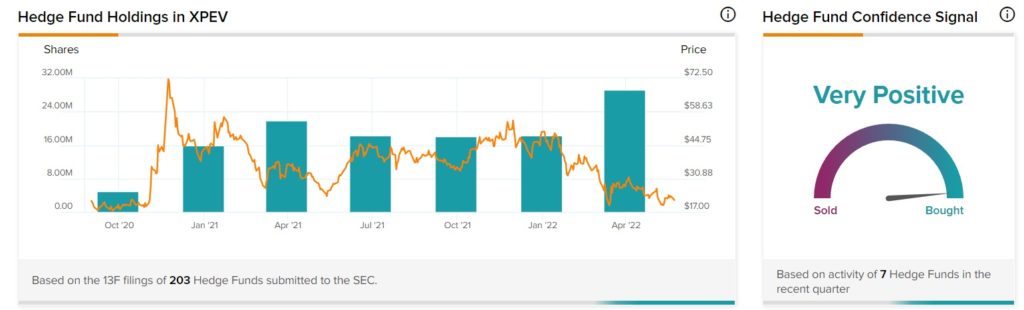

Hedge Funds’ Activity

Overall, the TipRanks’ Hedge Fund Trading Activity tool shows that the confidence of hedge funds in XPEV is currently Very Positive. Moreover, the cumulative change in holdings across all seven hedge funds that were active in the last quarter was an increase of 10.9 million shares.

Conclusion

XPeng’s growth in revenues and deliveries is a positive for the company. However, widening losses can hinder its growth prospects.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

SiriusXM Gets a Boost from Conan O’Brien

AstraZeneca Wins EU Approval for COVID-19 Vaccine as Booster

Meritor All Set to Expand Its Commercial Vehicle Portfolio