Shares of XPeng Inc. (NYSE: XPEV) fell 2.9% in Monday’s early trade after it released vehicle delivery results for February 2022. About 6,225 Smart EVs were delivered during the month, up 180% year-over-year but down 51.8% from January 2022.

XPeng engages in designing, developing, manufacturing, and marketing smart electric vehicles, primarily in China. It also offers an autonomous driving software system, bank loans, vehicle leasing, and auto insurance services.

Monthly deliveries comprised 3,537 P7 smart sports sedans (up 151% from the prior year), 2,059 P5 smart family sedans and 629 G3 & G3i smart compact SUVs.

Meanwhile, XPeng announced that it has completed the technology upgrade at the Zhaoqing plant. Also, production at the plant resumed in mid-February as planned. With this upgrade, the company has been able to accelerate the delivery of its significant order backlog in hand.

Further, XPeng revealed that during the month it was added to the Shenzhen-Hong Kong and Shanghai-Hong Kong Stock Connect programs, which allow qualified Chinese Mainland investors to trade eligible Hong Kong shares of XPeng.

Stock Rating

Last month, Barclays analyst Jiong Shao initiated a Buy rating on XPeng with a price target of $45 (23.7% upside potential from current levels).

Based on 3 Buys and 1 Hold, the stock has a Strong Buy consensus rating. The average XPeng price target of $48.57 implies 33.5% upside potential from current levels. Shares have gained 2.5% over the past year.

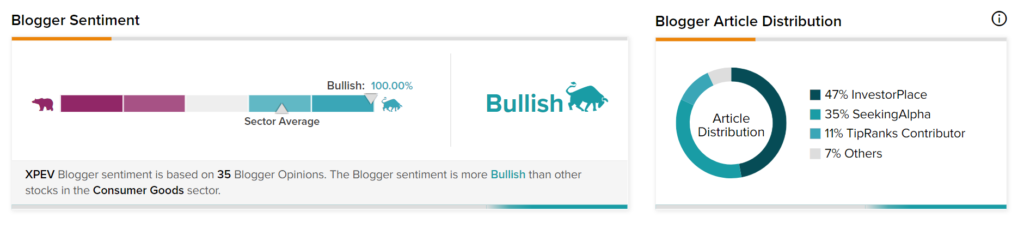

Blogger Opinion

TipRanks data shows that financial blogger opinions are 100% Bullish on XPEV, compared to a sector average of 71%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ambarella Declines 17% Despite Better-Than-Expected Q4 Results

Merck’s KEYTRUDA-LENVIMA Combo Bags Second Approval in Japan

Chevron Enters All-Cash Deal to Acquire Renewable Energy Group