XPeng shares (XPEV) are surging today after the Chinese EV company’s AI Day in Guangzhou revealed its autonomous driving capabilities. It also introduced the P7+, a smart electric sedan aimed at competing with Tesla’s (TSLA) Full Self-Driving software, which is expected in China next year. So far, XPeng noted that initial demand for the P7+ has been strong.

The P7+ model has moved away from LiDAR sensors, using the AI Eagle-Eye Vision system instead, which improves perception range by 125% and boosts recognition speed by 40%. Inside, the car features a 15.6-inch screen powered by the AI Tianji system and Qualcomm’s 8295P chip.

The P7+ offers two battery options (60.7kWh and 76.3kWh) with ranges up to 710km and comes with the ability to fast-charge to 80% in 20 minutes. With a starting price of RMB186,800 ($26,100), it includes features like a vision-only autonomous driving setup, along with a high-end Dynaudio sound system and a spacious interior.

Serious Competitor for Tesla

There’s no question that Chinese EV companies are a serious threat to Tesla. In fact, Elon Musk has himself warned about the growing competitiveness of Chinese EV companies. More specifically, he believes that they would “pretty much demolish most other companies in the world” if no trade barriers are put in place.

This is because Chinese manufacturers have the capabilities to match (or at least come close to matching) Tesla’s technology but at a much lower price point due to lower labor and material costs. Indeed, XPeng’s move away from LiDAR sensors is evidence of this since that is a big part of Musk’s strategy to produce cheaper vehicles.

However, given President-Elect Trump’s desire to place higher tariffs on China, it would help keep Tesla competitive on price in the U.S.

Is XPEV Stock a Good Buy?

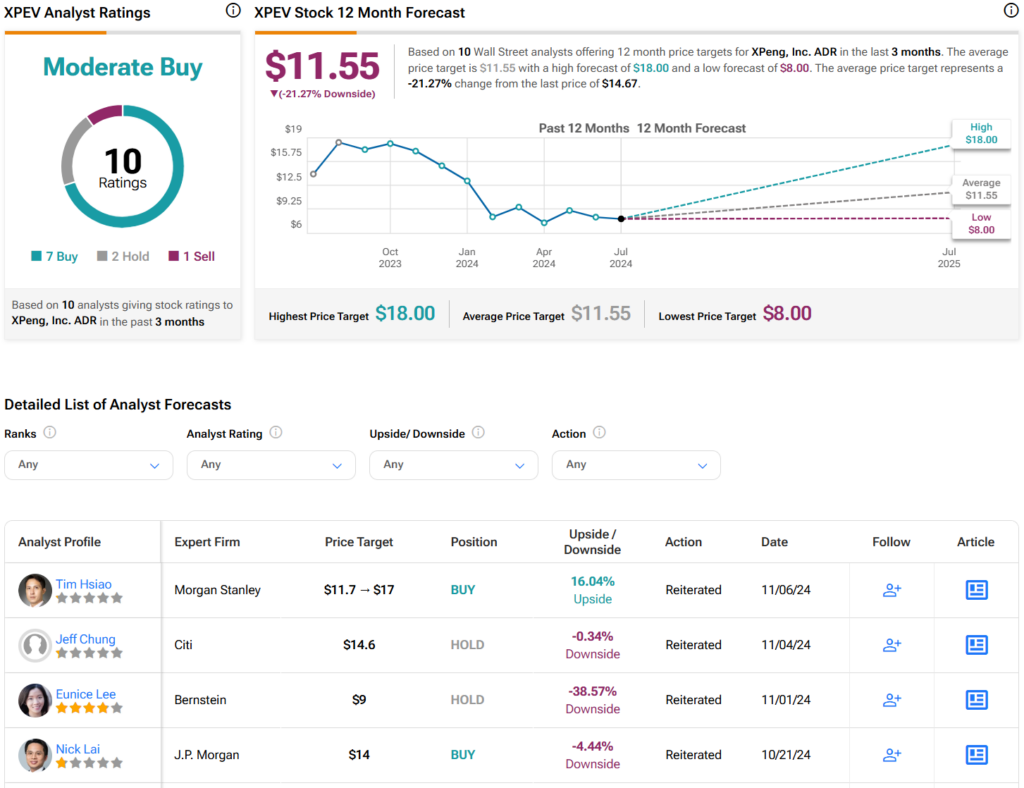

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XPEV stock based on seven Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 9% decline in its share price over the past year, the average XPEV price target of $11.55 per share implies 21.27% downside risk.

Questions or Comments about the article? Write to editor@tipranks.com