Slowing growth in China and regulatory headwinds, along with chip shortages and other near-term headwinds, kept investors cautious over Chinese EV stocks despite a bullish long-term outlook. Among others, China-based EV maker XPeng Inc. (NYSE: XPEV) lost over 30% in the past month.

Meanwhile, in expectation of strong numbers for January, shares of the company are climbing. They recorded a more than 2% rise in the pre-market trading at the time of writing, after closing 9.1% higher on Monday.

Strong momentum was visible in XPeng’s monthly deliveries of smart EVs for the month of January.

January Delivery Update

The company told investors that its total deliveries for the month stood at 12,922 vehicles. This represents a year-over-year increase of 115% and the fifth consecutive month of over 10,000 deliveries, even though there is a semiconductor shortage globally.

The total number of vehicles delivered included 6,707 deliveries of P7s (the company’s sports smart sedan) and 2,186 G3 and G3i smart compact SUVs.

Additionally, the P5 smart family sedans, which were launched in September 2021, reflected its wide acceptance by customers with 4,029 units delivered in January.

As of January 31, 2022, total smart EV deliveries stood over 150,000.

Tech Upgrade

XPeng is upgrading technology at its Zhaoqing plant, which is anticipated to accelerate the delivery numbers and cater to increasing demand.

Since January 17, 2022, XPeng has provided customers with fast and reliable charging services at 813 branded supercharging stations across 333 Chinese cities.

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average XPeng price prediction of $63.78 implies 81.76% upside potential from current levels.

Risk Analysis

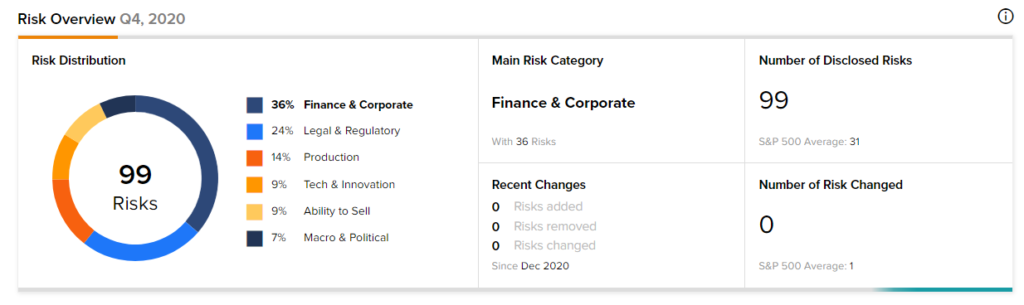

According to the new TipRanks Risk Factors tool, XPeng stock is at risk mainly from three factors: Finance & Corporate, Legal & Regulatory, and Production, which contribute 36%, 24%, and 14%, respectively, to the total 99 risks identified for the stock.

Despite strong numbers, given the already high-risk profile of the company, investors might want to be cautious before investing in this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Bristol Myers Squibb Gets Positive CHMP Opinion for Breyanzi; Shares Gain

Chevron’s Q4 Earnings Miss Expectations; Shares Drop Over 3%

AstraZeneca Summoned by Chinese Regulators over Suspected Medical Insurance Fraud