Electric vehicle stock Xpeng (NASDAQ:XPEV) likely had high hopes for its latest electric vehicle model and introduced it to the world in breathless terms, declaring it a likely industry “game changer.” Unfortunately, investors didn’t buy a word of it and sent Xpeng shares down over 4% in Friday morning’s trading session.

Admittedly, the X9—the latest model from Xpeng—is a departure from the norm. It’s burly with seven seats and built utilizing the SEPA 2.0 model used in China. It was introduced just days ago, with the dawning of the new year, and runs between 359,800 yuan and 419,800 yuan, or between $50,470 and $58,887.

As for what makes it a game changer, reports suggest that it has a top-notch infotainment system and an ability to rapidly shift seating from a standard seven-seater to an extraordinarily roomy four-seater with room for cargo. Some pictures even suggest the rear seats can function as recliners, complete with footrests, which is admittedly the kind of thing you don’t usually see in a car.

But Will It Help Xpeng Much?

Granted, we’re not going to be able to answer that question until we see more than a few days’ worth of sales return. No one will. Certainly, it’s got a unique proposition. Word from Deutsche Bank, meanwhile, suggests that the “aggressive” pricing could prove helpful, and volume may increase as a result. Though investors seem skeptical right now, that can turn on a dime, as we’ve all seen. Certainly, the macro environment isn’t helping, and there are signs that customers just aren’t that interested in electric vehicles, at least in the United States. Given production cuts at Ford (NYSE:F) on the F-150 Lightning pickup, trying to sell a $50,000-plus EV—even a roomy one—might not fly.

What is the Future Price of Xpeng Stock?

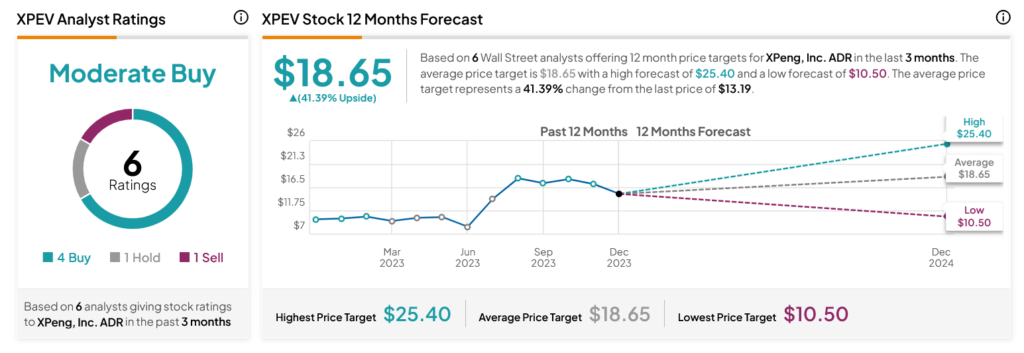

Turning to Wall Street, analysts have a Moderate Buy consensus rating on XPEV stock based on four Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 31.06% rally in its share price over the past year, the average XPEV price target of $18.65 per share implies 41.39% upside potential.