While the overall stock market has slumped in recent weeks, metals and mining stocks are showing no signs of weakness and are instead picking up more momentum. The S&P 500 (SPX) is down 3.2% over the past month, and the tech-centric Nasdaq (NDX) is down 3.8%, but the SPDR S&P Metals and Mining ETF (NYSEARCA:XME), which invests in these metals and mining stocks, is up 1.5% over the same time frame.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

I’m bullish on XME based on the broad exposure it gives investors to a diverse group of attractive metals like gold, copper, and even uranium at a time when we could be in the early innings of a bull market for many of these metals, as we’ll discuss below.

What Is the XME ETF’s Strategy?

XME invests in an index of metals and mining stocks. According to the fund, XME “seeks to provide exposure to the metals & mining segment of the S&P TMI (Total Market Index), which comprises the following sub-industries: Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel.”

It uses a modified equal-weighted approach and invests in large-, mid-, and small-cap stocks.

Are We in the Early Innings of a Metals and Mining Bull Market?

Whether it’s precious metals like gold or industrial metals like copper, metal prices have surged in recent months, leading many analysts and observers to posit that we could be in the early stages of a new bull market for metals.

Take gold, for example, which recently soared to record highs. Gold is viewed by people all over the world as a store of value and an alternative to the U.S. dollar. As the U.S. debt grows to record levels, gold has become an increasingly appealing alternative as a safe-haven asset to people both in the U.S. and internationally.

Furthermore, central banks around the world, such as China, Turkey, India, Singapore, and others, have been loading up on gold and replenishing their gold reserves over the past year.

China imported a record amount of gold in 2023 as Chinese investors looked for a safe-haven asset while China’s equity and property markets endured downturns. In fact, the $90 billion worth of gold that China imported represents a stunning nine-fold increase from just three years ago.

And it’s not just precious metals like gold. Copper is having a moment of its own as industrial activity in both the U.S. and China rebounds after many months of declines.

Copper looks particularly intriguing over the long term due to looming supply constraints and potentially increasing demand. This increase is driven by the growth of AI technology, which necessitates more data centers—a key end market for copper wiring. Additionally, as a vital component in electric vehicles, the power grid, and wind turbines, copper could significantly benefit from a shift towards more renewable energy, should that come to fruition.

Analysts from Citigroup (NYSE:C) recently postulated that we could be in a second bull market for copper this century, stating, “Explosive price upside is possible over the next two to three years.”

Meanwhile, uranium prices hit a 16-year high in January. Although prices have pulled back from those highs, uranium remains promising over the long term. The world is increasingly embracing nuclear power as a method to generate electricity without emitting greenhouse gases.

With different metals all performing well and exhibiting potential for further upside, it makes sense to take a diversified approach and invest in metals as a whole instead of trying to pick an individual winner, which is exactly what XME enables investors to do, as we’ll discuss in the next section.

Basket Approach Toward Metals and Mining

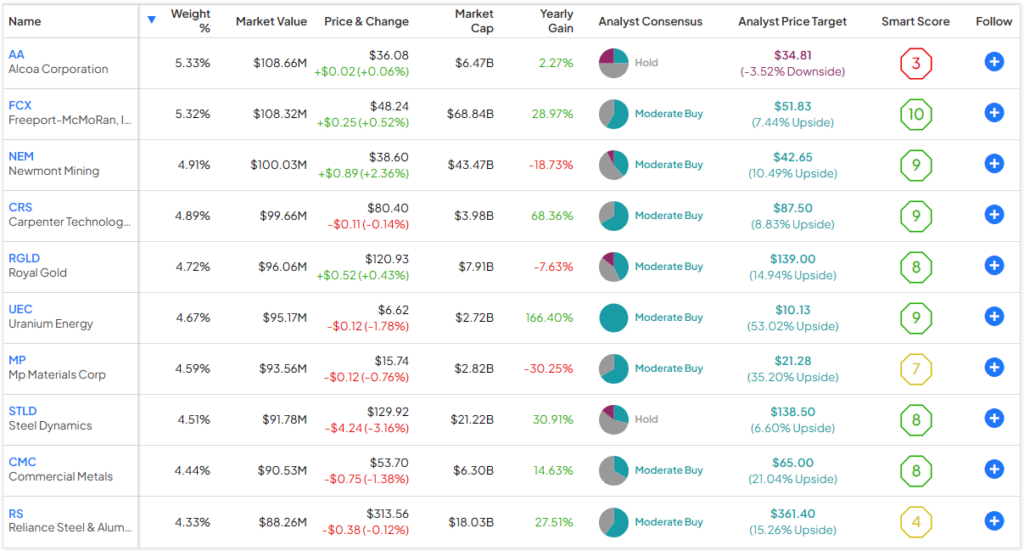

XME holds 33 stocks, and its top 10 positions make up 47.5% of holdings. Below, you’ll find a table of XME’s top 10 holdings using TipRanks’ holdings screen.

While XME doesn’t necessarily own a ton of different names, it doesn’t need to as it still gives investors exposure to the full spectrum of different types of metals, including precious metals, base metals and more.

For example, Freeport McMoran (NYSE:FCX) is the world’s largest copper company, while Newmont Mining (NYSE:NEM) is a major gold miner that is also involved in silver, copper, and more. Meanwhile, Alcoa (NYSE:AA), the fund’s largest holding, produces aluminum, while Steel Dynamics (NASDAQ:STLD) and Commercial Metals (NYSE:CMC) produce steel.

XME even wades into more exotic parts of the metals sector with investments in Uranium Energy (NYSEMKT:UEC), which explores for and mines uranium, a promising energy source. Another investment, MP Materials Corp (NYSE:MP), produces rare earth metals used in end products like electric vehicles, drones, and more.

Compelling Performance in Recent Times

Let’s get this out of the way: XME has been a bit of a laggard over the past decade, with an underwhelming 10-year annualized return of just 5.4%.

But more recently, the fund has been a lot more exciting. For example, it has a much more exciting 16.1% annualized return over the past three years and an even more promising 16.9% return over the past five years, which is a long enough time frame for me to believe that its strong recent performance is more than just a flash in the pan.

It seems likely that we could be in the early stages of a bull market for metals like copper, gold, and beyond, as discussed above, so XME’s performance could continue to impress.

Does XME Pay a Dividend?

While few people are going to write home about XME’s dividend yield, it’s worth noting that it does pay a dividend and currently yields 0.9%.

What Is XME’s Expense Ratio?

Like many of the SPDR ETFs, XME maintains an expense ratio of 0.35%. This means that an individual investing $10,000 into the fund will pay $35 in fees annually. While this doesn’t stand out as being particularly cheap, it isn’t particularly expensive either, as it is below the average expense ratio for all ETFs (0.57%).

Is XME Stock a Buy, According to Analysts?

Turning to Wall Street, XME earns a Moderate Buy consensus rating based on 21 Buys, 12 Holds, and one Sell rating assigned in the past three months. The average XME stock price target of $70.20 implies 18.4% upside potential.

Looking Ahead

I’m bullish on XME because, at a time when metals and mining stocks are picking up momentum, XME enables investors to gain exposure to a wide variety of these stocks. I like the fact that XME offers investors exposure to a diverse range of sectors, including gold miners, copper miners, steel producers, companies involved in uranium and rare earth metals, and more. This broad focus is beneficial, especially as we may be in the early stages of a bull market for metals.