Since 2022, the turbulent war landscape in many parts of the world has caused the demand for defense products and aircrafts to increase drastically. Investing in defense stocks is considered a defensive play, as these companies tend to outperform during times of macro and geopolitical instability. Plus, these companies tend to have stable revenue streams that are generated from government contracts. What’s more, defense companies also pay regular dividends, making for an interesting investment play.

Defense ETFs are a good way to gain exposure to a wide variety of defense companies. We used TipRanks’ ETFs Comparison tool for Defense ETFs to compare SPDR S&P Aerospace & Defense ETF (XAR), iShares U.S. Aerospace & Defense ETF (ITA), and Global X Defense Tech ETF (SHLD) to determine the best Defense ETF, according to analysts’ ratings and price target appreciation. The ETF ratings and price targets are based on the consolidated ratings and price targets of each stock in the fund.

TipRanks’ ETF Comparison Tool enables the comparison of ETFs based on several parameters, such as AUM (assets under management), funds flow, expense ratio, technicals, performance over different time periods, and TipRanks Essential tools.

SPDR S&P Aerospace & Defense ETF (XAR)

The SPDR S&P Aerospace & Defense ETF seeks to track the performance of the S&P Aerospace & Defense Select Industry Index. The index has an equal weighted methodology for stock selection including small, mid, and large cap stocks from the aerospace and defense sectors.

XAR pays a regular quarterly dividend of $0.16 per unit, reflecting a yield of 0.56%. Meanwhile, its expense ratio is 0.35%, one of the lowest in this ETF category.

As of June 24, XAR had a total of 34 holdings, with an AUM (assets under management) of $2.15 billion. Its top three holdings are Woodward (WWD), Heico Corporation (HEI), and Howmet Aerospace (HWM), representing 13.67% of the portfolio.

Is XAR ETF a Good Investment?

On TipRanks, XAR has a Moderate Buy consensus rating based on 24 Buys, nine Holds, and one Sell rating. The average SPDR S&P Aerospace & Defense ETF price target of $169.56 implies 20.8% upside potential from current levels. XAR has gained 5.1% so far in 2024.

iShares U.S. Aerospace & Defense ETF (ITA)

The iShares U.S. Aerospace & Defense ETF seeks to track the performance of the Dow Jones U.S. Select Aerospace & Defense Index, which is composed of only American companies from the aerospace and defense industry. The companies in this index primarily engage in the manufacture of commercial and military aircrafts and defense equipment. ITA is largest aerospace and defense ETF, based on AUM.

ITA pays regular quarterly dividend of $0.30 per unit, reflecting a yield of 0.92%. The ETF’s expense ratio is slightly higher than XAR’s at 0.40%.

As of June 24, ITA had an AUM of $6.27 billion with 37 holdings. Its top three holdings include GE Aerospace (GE), Raytheon Technologies (RTX), and Boeing Company (BA). Combined, these three contribute 63.18% of the total portfolio.

Is ITA a Good ETF?

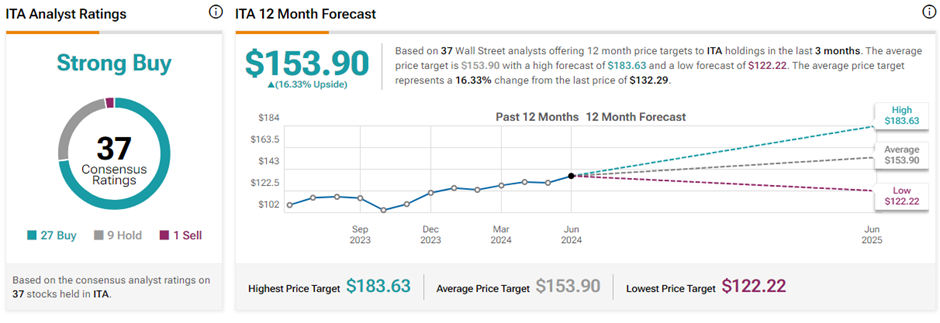

On TipRanks, ITA commands a Strong Buy consensus rating based on 27 Buys, nine Holds, and one Sell rating. The average iShares U.S. Aerospace & Defense ETF price target of $153.90 implies 16.3% upside potential from current levels. ITA has gained 5.7% so far this year.

Global X Defense Tech ETF (SHLD)

The Global X Defense Tech ETF seeks to track the performance of the Global X Defense Tech Index. The index invests in companies that are engaged in the development and management of cybersecurity systems, artificial intelligence and big data, advanced military systems as well as hardware including robotics and aircrafts for defense application.

SHLD has one of the highest expense ratios among the three ETFs of 0.50%, while it has the smallest AUM, of $257.14 million, among the three. Notably, SHLD has a semi-annual dividend distribution policy. Its last dividend of $0.07 per unit was paid on January 8, carrying a yield of 0.21%.

Currently, SHLD has 36 holdings with the top three contributing 24.16%. The top three companies are Raytheon Technologies, General Dynamics (GD), and Lockheed Martin (LMT).

Is SHLD a Good ETF?

With 20 Buys, 15 Holds, and one Sell rating, SHLD has a Moderate Buy consensus rating on TipRanks. The average Global X Defense Tech ETF price target of $36.68 implies 10% upside potential from current levels. Year-to-date, SHLD has gained 20.4%.

Key Takeaways

Among the three Defense ETFs discussed above, analysts expect the SPDR S&P Aerospace & Defense ETF (XAR) to offer the highest upside potential in the next twelve months. The XAR is a broad-based ETF with wide representation of the aerospace and defense sector, carrying a low expense ratio and high upside potential.