Investors looking for promising investment options could consider stocks that are currently seeing a downtrend but have strong growth potential. One strategy to identify such stocks is to focus on those trading near their 52-week lows. Thus, using the TipRanks Stock Screener tool, we have identified three stocks trading 5% to 10% above their 52-week lows, all rated as Strong Buy by analysts: Wynn Resorts (NASDAQ:WYNN), Baidu (NASDAQ:BIDU), and IDEX Corp. (NYSE:IDEX).

Let’s delve deeper.

Is WYNN a Buy or Sell?

Wynn is a luxury hotel and casino operator. WYNN stock has declined 13.3% in the past year. The stock closed at $87.28 per share on Wednesday, which is 7.7% above its 52-week low of $81.01.

Strong performance in key markets like Las Vegas and Macau, along with expansion in the UAE market, could help drive substantial growth over the long term.

On TipRanks, Wynn has a Strong Buy consensus rating based on nine Buy and three Hold ratings. The analysts’ average price target on WYNN stock of $124.70 implies 42.87% upside potential from current levels.

Is Baidu a Buy, Sell, or Hold?

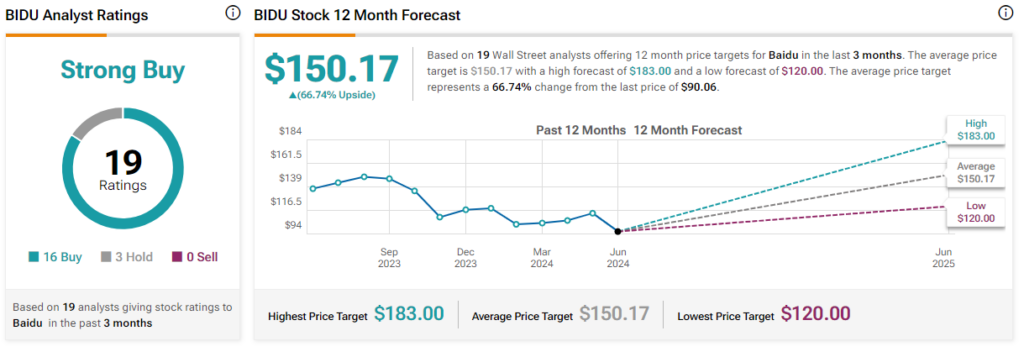

BIDU is a Chinese multinational technology company. The stock is down 24.4% over the past year and is currently 5.9% above its 52-week low, which closed at $90.06 per share on Wednesday. Baidu’s efforts to diversify its operations into profitable areas, including robotaxis and cloud business, remain impressive.

Overall, Wall Street is optimistic about the stock. The stock has a Strong Buy consensus rating based on 16 Buys and three Holds. The analysts’ average price target on BIDU stock of $150.17 implies a 66.74% upside potential from current levels.

Is IEX a Good Buy?

IDEX provides pumps, metering products, and other engineered products. The stock has fallen 6.3% in the past year, and it closed at $195.14 per share on Wednesday, 6.8% above its 52-week low. The company enjoys pricing power due to its strong position in the industrial market, thereby enabling IEX to maintain healthy revenue growth.

IDEX has received seven Buy and two Hold recommendations for a Strong Buy consensus rating. The analysts’ average price target on IEX stock of $255.50 suggests an upside potential of 30.93%.

Questions or Comments about the article? Write to editor@tipranks.com