World Wrestling Entertainment (WWE) (NYSE:WWE) has always thrived on its own internal drama. However, it’s also taken on some external drama as well, in the form of, among other things, clashes with the courts system. While there’s a lot of turmoil taking place in WWE circles, this newly-minted drama isn’t balking investors even slightly. In fact, WWE is up slightly in Wednesday afternoon’s trading.

The drama at WWE is indeed getting thick. As CEO Vince McMahon faces a federal subpoena, and the offices of WWE were also subject to a recently-executed federal search warrant, there is clear concern among investors about what’s going on at the top, and how it might relate to their own investment. Word from WWE’s 10-Q filing offered some light on the matter, noting that “alleged misconduct by McMahon” had been investigated by a “special board committee” in the fourth quarter. That’s good news, but less good is that the government is still conducting its own investigations into the matter, which may produce more unsettling results.

However, investigations or no, the second quarter earnings report for WWE released earlier today made for a real winner. Not only did WWE post a win in earnings, coming in at $0.91 against analyst projections that called for $0.89 per share, it also won in revenue. WWE posted $410.3 million in revenue for the quarter, which was not only ahead of analyst projections calling for $397.59 million, it was also up 25% against this time last year. With viewership for SmackDown and Raw both up substantially—Raw was up 19% and SmackDown was up 26%–that meant a lot of gains for WWE.

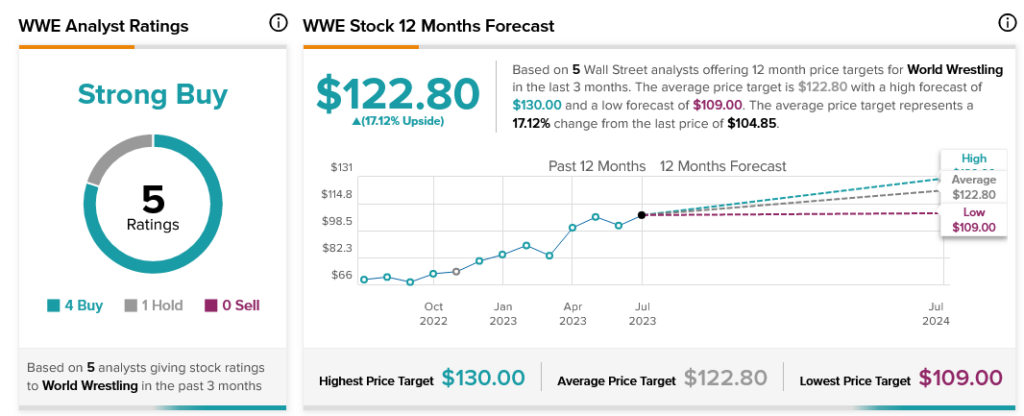

Indeed, analysts seem largely unfazed by the developments. Currently, WWE stock is considered a Strong Buy by analyst consensus, with four Buy ratings and one Hold. Further, with an average price target of $122.80, WWE stock comes with an upside potential of 17.12%.