Shares of WPP jumped almost 5% after the world’s largest advertising company said that it is making progress on its goal to return to 2019 net sales by 2022.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

WPP (WPP) set out medium-term targets and provided investors with guidance for 2021 and 2022. In the medium-term, the company plans to reinstate its stock repurchase programme in 2021, and introduce a new dividend policy with a pay-out ratio of around 40% of headline EPS. It expects double-digit headline EPS growth over the next three years, as a result of businesses shifting towards e-commerce and digital services.

In the two months to November, like-for-like net sales declined 6.7%. For 2020, the London-based advertising giant forecasted its like-for-like net sales to drop by 8.4%. Analysts had expected WPP to post an 8.8% decline in full-year organic sales. For next year, the company projected like-for-like net sales to grow at mid-single digits.

“It has been two years since we set out our strategy to return WPP to growth. Since then, we have made significant progress, with stronger agency brands, new leadership, a simpler structure and a strong balance sheet,” stated WPP CEO Mark Read. “We can see the results in our industry-leading new business performance, with $5.6 billion won in the first nine months including Alibaba, HSBC, Intel, Uber and Unilever.”

Additionally, the company set out a goal to fund growth and improve profitability through gross annual cost savings of £600 million by 2025, with approximately two-thirds reinvested in talent, incentives and technology.

Read disclosed that “£400 million of the targeted £600 million savings will be used to fund investment in the capabilities and technology that will drive future growth for our people, our clients, our business and our shareholders.” As a result, the company expects to expand its e-commerce and technology business from 25% to 40% by 2025.

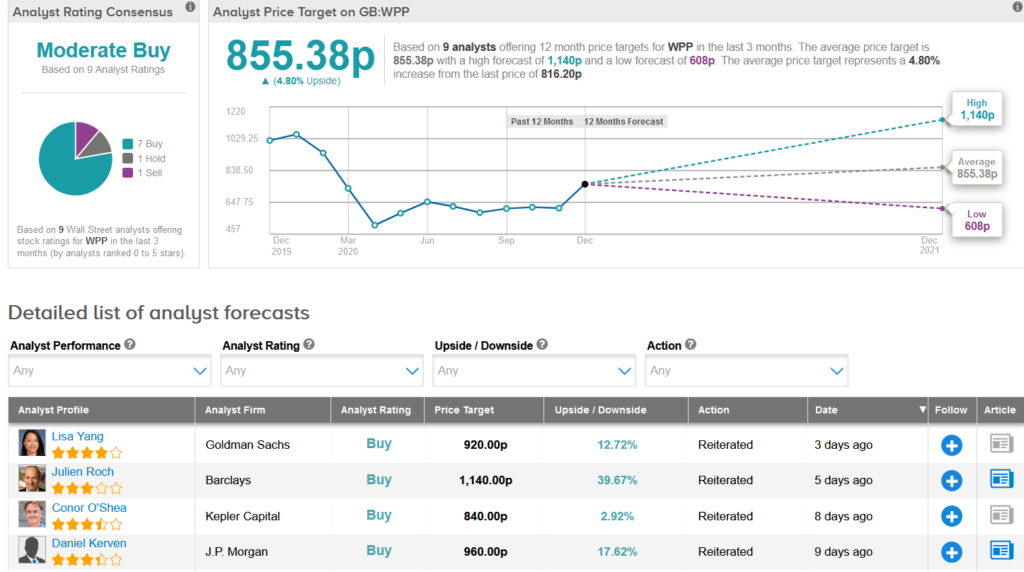

On Dec. 8, J.P. Morgan analyst Daniel Kerven raised the stock’s price target to 960p (17% upside potential) from 750p and reiterated a Buy rating.

Shares have been hit with a 25% decline this year, but the stock still scores a cautiously optimistic Moderate Buy analyst consensus. That’s based on 7 Buys, 1 Hold, and 1 Sell. (See WPP stock analysis on TipRanks)

Looking ahead, the average analyst price target of 855.38p implies 4.5% upside potential over the coming year, should the target be met.

Related News:

Tilray Pops 19% On Aphria Cannabis Deal; Analyst Says “Sensible” Deal

Quest Lifts 2020 Sales, Profit Guidance As Covid-19 Testing Picks Up

Eli Lilly To Buy Prevail In $1B Gene Therapy Deal; Shares Jump 6%