Workhorse Group (NASDAQ:WKHS) shares are trending 11% lower today after the electric vehicle company announced its third-quarter results. Despite a nearly 94% year-over-year increase, revenue of $3 million missed analysts’ expectations by a wide margin of $17.9 million. EPS of -$0.11, however, came in better than estimates by $0.01.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

During the quarter, Workhorse initiated the production of the W56 stripped chassis and step van models and increased the output of its W750 step van. Additionally, the company sold additional drones to UPS (NYSE:UPS) for FAA certification and field testing.

Despite this progress, the company’s quarter was marked by a lack of HVIP voucher availability in California. The HVIP (Hybrid and Zero Emission Truck and Bus Voucher Incentive Project) in California provides vouchers for fleets for the acquisition of EVs and clean vehicles. Although this issue was resolved last week, the company has lowered its outlook for the remainder of 2023. It now anticipates revenue for Fiscal year 2023 to be between $10 million and $15 million.

Further, the company is in talks to tap funding from third parties and is evaluating strategic alternatives for its Aero business. Interestingly, this move comes after Workhorse delivered three additional drones and initiated drone assembly at its Ohio facility in the third quarter.

What Is the Forecast for WKHS Stock?

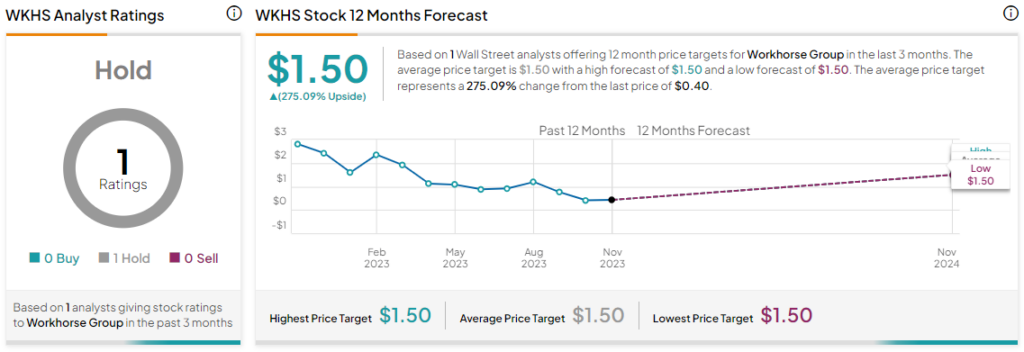

Today’s price decline comes on top of a nearly 85% price erosion in Workhorse shares over the past year. D.A. Davidson’s Michael Shlisky, the only analyst tracking Workhorse at present, has reiterated a Hold rating on the stock with a $1.50 price target. This points to a 275% potential upside in WKHS stock.

Read full Disclosure