Workday announced stronger-than-expected 3Q results, thanks to the double-digit growth in its subscription revenues. However, shares of the tech-based financial and human capital management software vendor fell 3.1% in extended trading on Thursday due to the concerns about the lingering effect of COVID-19 on the company.

Workday’s (WDAY) 3Q earnings of $0.86 per share jumped 62.3% year-over-year and came in ahead of the analysts’ estimate of $0.67. The company’s revenues of $1.11 billion rose 17.9% year-over-year and exceeded the $1.09 billion consensus estimate, driven by strong subscription revenues.

Workday’s subscription revenues rose 21.3% to $968.5 million and also exceeded management’s guidance range of $948 million to $950 million. Subscription revenue backlog also increased by 23.4% during the quarter.

Buoyed by strong 3Q results, the company raised its fiscal 2021 subscription revenue outlook to $3.773 billion to $3.775 billion, compared to the earlier guidance of $3.73 billion to $3.74 billion. For 4Q, the company expects subscription revenue to be $991 million to $993 million. Further, the company’s CFO Robynne Sisco said, “As we enter Q4, we are increasing our pace of investments to capitalize on the long-term opportunity that we see ahead.” (See WDAY stock analysis on TipRanks)

However, Sisco also warned that “the near-term uncertainty remains higher than normal.” He added, “While we have seen some recent stability in the underlying environment, headwinds due to COVID remains particularly to net new bookings. And given our subscription model, these headwinds that have impacted us all year will be more fully evident in next year’s subscription revenue weighing on our growth in the near term.”

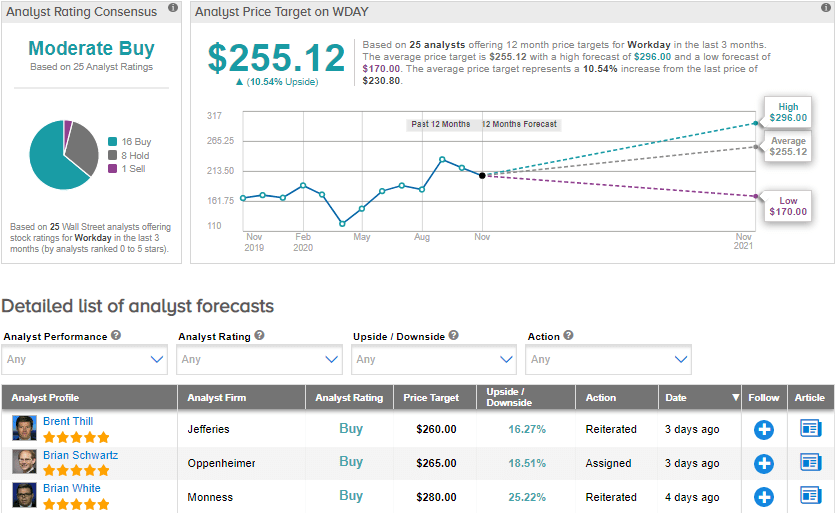

Ahead of the results, Jefferies analyst Brent Thill had expected Workday to deliver “another beat and raise” report but also anticipated a conservative set up into 3Q earnings. In a note to investors, Thill said that FY22 subscription revenue estimates show a slowdown in the growth rate compared to FY21. However, he believes that a recovery in pipelines in FY22 should reaccelerate subscription revenue growth. Therefore, he maintained a Buy rating with a price target of $260 (12.7% upside potential).

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 16 Buys, 8 Holds and 1 Sell. The average price target stands at $255.12 and implies upside potential of about 10.5% to current levels. Shares have risen by about 40.4% year-to-date.

Related News:

Shoe Carnival Gains As E-Commerce Sales Fuel 3Q Profit Beat; Analyst Raises PT

NetEase Rises On 3Q Profit Win; Street Sees 25% Upside

Cubic Drops 4.5% As 4Q Sales Miss The Street