Shares of Workday soared 11.9% in the extended trading session on Thursday after the company reported stronger-than-expected 2Q results and raised guidance for fiscal 2021.

Workday’s (WDAY) 2Q revenues climbed 19.6% to $1.06 billion year-over-year and surpassed analysts’ expectations of $1 billion. Its adjusted EPS increased 90.9% to $0.84 year-on-year and beat Street estimates of $0.66.

The human-resources cloud-software company raised its fiscal 2021 subscription revenue guidance range to $3.73-$3.74 billion from $3.67-$3.69 billion projected earlier. It also revised upward the non-GAAP operating margin outlook for the fiscal year to 18% from 16%. (See WDAY stock analysis on TipRanks).

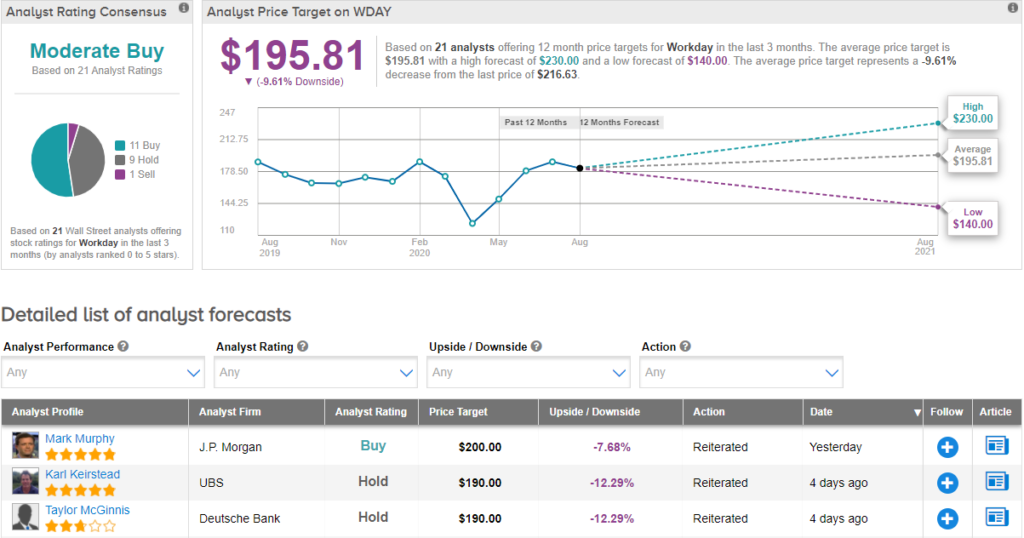

Following the positive results, J.P. Morgan analyst Mark Murphy increased his price target to $200 from $190 (7.7% downside potential) and maintained a Buy rating. Murphy said that the acceleration in digital transformation due to the pandemic is a “positive tailwind” in the medium to long-term.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 11 Buys, 9 Holds, and 1 Sell. With shares up about 32% year-to-date, the average price target of $195.81 implies downside potential of about 9.6% to current levels.

Related News:

Oppenheimer Lifts Marvell’s PT Ahead Of 2Q Earnings

BMO Lowers Palo Alto’s PT After 4Q Beats Estimates

NetApp Leaps 11% In After-Hours On Strong 1Q Results