Woodside Energy Group (ASX:WDS) shares shot up almost 5% to a trading day peak of AU$33.88. The stock opened at AU$33.01, having closed the previous day at $AU32.34. The spike came after a top Citigroup analyst upgraded the stock to a Buy and assigned it a price target that shows modest upside potential.

It was a good day for energy stocks as the S&P/ASX 200 Energy [XEJ] index edged up around 4%. Rising alongside Woodside Energy stock, were New Hope Corporation Limited (ASX:NHC) and Whitehaven Coal Limited (ASX:WHC) shares.

Perth-headquartered Woodside Energy is an oil and gas group, established in 1954. The company is profitable and its stock currently offers an above-average dividend yield of 5.7%.

Citigroup’s Paul McTaggart upgrades Woodside stock

Citigroup’s Paul McTaggart upgraded Woodside stock rating to a Buy from a Hold. The analyst also raised the price target on the stock from AU$33.30 to AU$36.50, which now indicates more than 8% upside potential to current levels. McTaggart is a 5-star analyst whose calls have turned out to be profitable 57% of the time, with an average return of 17.1% per transaction.

Aside from the analyst upgrade, Woodside’s price ascent, came on the back of moving oil prices, which edged up overnight amid supply disruption fears.

Is WDS a good buy?

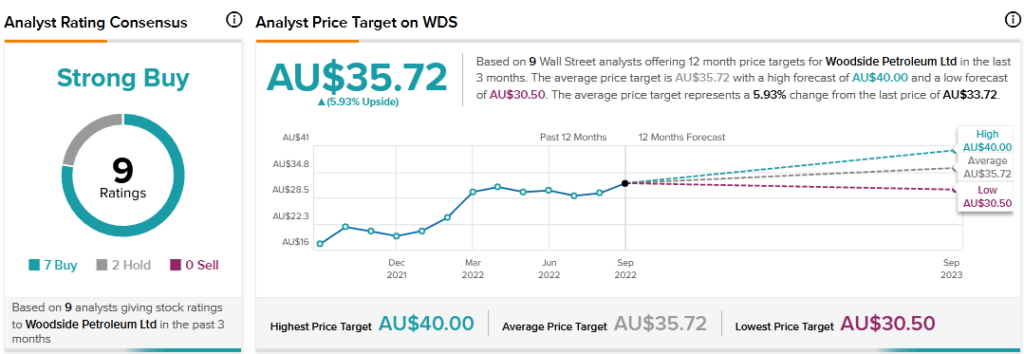

Woodside Energy has been a favourite among energy stocks, gaining almost 50% year-to-date. According to TipRanks’ analyst rating consensus, WDS stock is a strong Buy based on seven Buys and two Holds. The average Woodside share price target of $AU35.72 implies close to 6% upside potential.

Woodside scores an eight out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has potential to outperform market expectations. Moreover, Woodside stock is seeing positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 92% Bullish on WDS, compared to a sector average of 72%.

Final thoughts

Although Woodside shares only show modest upside after a good run so far in 2022, it remains among the most highly regarded energy stocks on the ASX. WDS stock may be worth a look for investors seeking income, considering the stock’s lucrative dividend yield. Moreover, as energy needs remain a constant, oil and gas businesses like Woodside are likely to fare better than others in the advent of a recession.