Shares of silicon carbide and gallium nitride solutions provider Wolfspeed (WOLF) rose sharply yesterday following the company’s robust fourth-quarter showing. Revenue jumped 56.7% year-over-year to $228.5 million, outperforming estimates by ~$21 million. Impressively, Wolfspeed’s earnings per share of -$0.02 beat estimates of -$0.10. This is the eighth consecutive quarter that WOLF has successfully beaten bottom-line consensus estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Further, the company has improved its gross margin to 36.5% from 32.2% while also notching design-ins of $2.6 billion during the quarter.

The CEO of WOLF, Gregg Lowe, remarked on the progress, “We announced a number of exciting customer wins, opened the world’s first fully automated 200mm silicon carbide fab at Mohawk Valley, and made significant strides in growing our top-line, while also improving profitability.”

Looking ahead, for the first quarter of Fiscal Year 2023, WOLF sees revenue landing between $232.5 million and $247.5 million. Net loss per share is expected to range between -$0.02 and -$0.08.

Is WOLF a Good Stock?

Following the results, SMBC Nikko analyst Srini Pajjuri has reiterated a Buy rating on WOLF stock while increasing the price target to $120 from $90, implying 6.25% upside potential. Overall, the Street has a Moderate Buy consensus rating on the stock based on seven buys, four holds, and one sell assigned in the past three months. The average WOLF stock price target of $110.73 implies 1.7% upside potential.

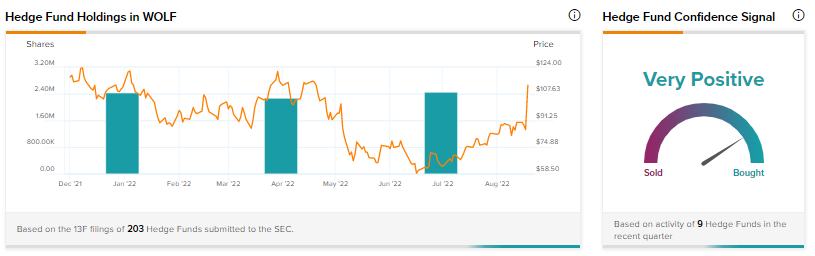

In the meantime, our data indicates hedge funds are very positive on Wolfspeed and have increased their WOLF stock holdings by 184,700 shares in the last quarter. Importantly, Richard Driehaus’ Driehaus Capital Management has upped its WOLF holdings by 109.71%.

Takeaway – Improving Results Could Attract More Investors to WOLF Stock

WOLF continues to deliver results driven by demand from its end markets, such as electric vehicles, fast charging, renewable energy, 5G, and aerospace and defense. A steady improvement in the bottom line and increasing hedge fund interest should attract investor attention to the stock.