Winnebago Industries (WGO) shares jumped almost 6% on June 22 after the leading manufacturer of outdoor lifestyle products and motorhomes delivered blowout fiscal third-quarter results, well above analyst expectations.

Q3 Beat

The company reported stellar quarterly earnings of $4.13 per share, which is significantly higher than analysts’ estimates of $2.96 per share and 84.4% higher than earnings of $2.24 per share reported in the prior-year period.

Similarly, revenue climbed a whopping 52% to $1.46 billion compared to the prior-year period and outpaced the Street’s estimate of $1.21 billion.

The outstanding revenue growth is attributed to robust organic growth of 41% coupled with increased pricing and shipments related to the strong dealer order backlog.

Furthermore, the gross profit margin increased 100 basis points to 18.7%, driven by operating leverage, better pricing, and a favorable mix offsetting higher material and component costs.

CEO’s Comments

Winnebago CEO, Michael Happe, commented, “As we look ahead to our last quarter in the fiscal year, we will maintain our focus on executing our proven strategy and build on our momentum to further grow and solidify our expanding market position, while driving long-term value for end customers, dealers, employees, and shareholders.”

Wall Street’s Take

Following the upbeat results, BMO (BMO) Capital analyst Gerrick Johnson reiterated a Buy rating on Winnebago Industries with a price target of $85 (75.69% upside potential).

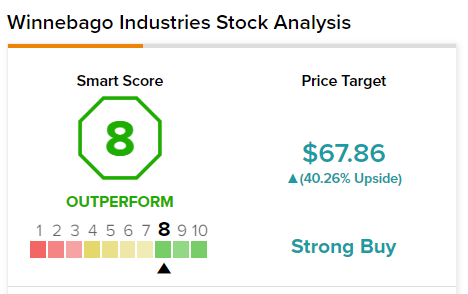

Turning to Wall Street, Winnebago comes in as a Strong Buy based on six Buys and two Holds. The average Winnebago Industries price target is $67.86, implying 40.26% upside potential.

TipRanks’ Smart Score

WGO scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Conclusion

Despite supply chain inconsistencies and heightened inflationary pressures, WGO not only reported an impressive beat but also gained market share, which is commendable.

The positive management commentary, coupled with the regular return of capital through dividends and share buybacks, buoys the investor’s confidence in the stock.