Shares of Winnebago Industries, Inc. (WGO) gained 1.1% in Wednesday’s extended trading session after the company announced the approval of a $200 million stock repurchase program. The new plan replaces the $70 million still outstanding under the previous share buyback program.

Winnebago engages in the design, development, manufacture, and sale of motorized and towable recreation products. (See Winnebago stock charts on TipRanks)

Repurchases under the new plan will be carried out at the company’s discretion in the open market or via private transactions. Also, the repurchase program comes with no expiration date and may be suspended from time to time at Winnebago’s discretion without prior notice.

Winnebago’s President and CEO, Michael Happe, said, “By continuing to grow revenues, gain market share, drive enhanced levels of profitability and cash flow, we have the opportunity to pass these successes to our shareholders in the form of higher dividends and share repurchase, all while continuing to emphasize our organic and inorganic growth imperatives and maintain a strong, healthy balance sheet.”

Earlier this month, BMO Capital analyst Gerrick Johnson maintained a Buy rating on Winnebago and raised the price target to $100 (32% upside potential) from $90.

Johnson noted, “We believe Winnebago is well positioned to benefit from ongoing strong RV retail demand… Looking further out, we think the acquisition of Barletta will provide another avenue of market share capture for the company.”

Overall, the Street has a bullish outlook on the stock, with a Strong Buy consensus rating based on 3 Buys and 1 Hold. The average Winnebago price target of $90 implies upside potential of about 18.8% from current levels.

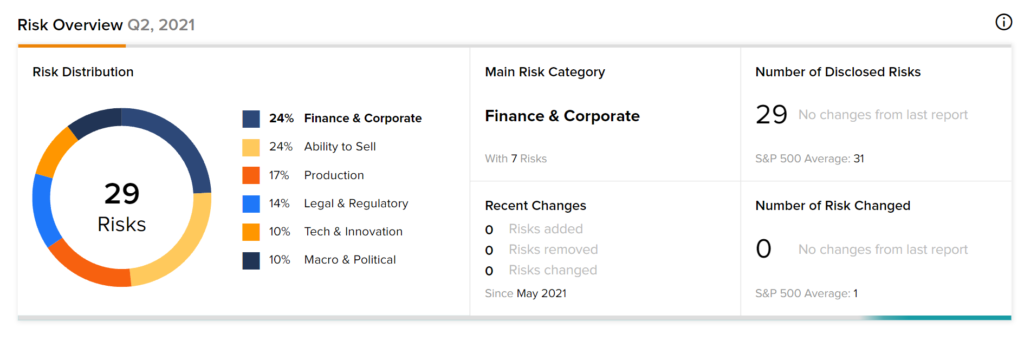

Investors should always be aware of the risks involved in any stock. According to the new TipRanks Risk Factors tool, WGO is at risk mainly from two factors: Finance and Corporate, and Ability to Sell, each contributing 24% to the total 29 risks identified for the stock. Under the Finance & Corporate risk category, Winnebago has 7 risks, details of which can be found on the TipRanks website.

Related News:

JPMorgan Q3 Results Beat Expectations

Qualcomm Increases Share Buyback Plan by $10B

Smart Global Shares Gain 6% on Solid Q4 Results