Willis Towers Watson (WLTW) has increased share repurchase authorization of the company’s common stock by up to $4 billion. The company offers a range of insurance brokerage, reinsurance and risk management consulting services.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The authorization is in addition to the $500 million remaining on the current open-ended repurchase authority. The buyback plan comes with no expiration date. (See Willis Towers Watson stock chart on TipRanks)

On July 26, 2021, the company announced to increased the existing share repurchase program by $1 billion. In December 2020, it increased its quarterly dividend by 4.4% to $0.71 per share.

Last month, MKM Partners analyst Harry Fong reiterated a Buy rating on the stock and raised the price target to $285 from $250. The new price target implies upside potential of 23.4% from current levels.

The analyst seems optimistic about the company’s Investor Day presentation. Fong noted that Willis Towers Watson delivered more than what was expected from its forward outlook.

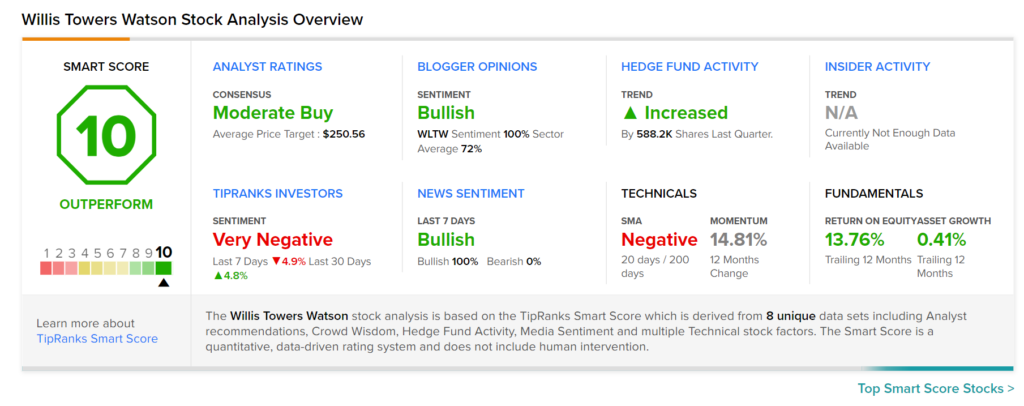

Based on 5 Buys and 4 Holds, the stock has a Moderate Buy consensus rating. The average Willis Towers Watson price target of $250.56 implies 8.5% upside potential from current levels. Shares have gained 13.4% so far this year.

Willis Towers Watson scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Sonic Automotive to Acquire RFJ Auto Partners; Shares Rise 2.3%

Paccar Partners with FedEx, Aurora for Commercial Pilot of Autonomous Trucks

General Electric in Talks to Sell Nuclear Assets — Report