The U.S. Commodity Futures and Trading Commission (CFTC) sued one of the largest cryptocurrency platforms, Binance, along with its CEO, Changpeng Zhao (CZ), and ex-compliance officer, Samuel Lim. The blow comes as regulators pin down malpractices in the crypto world. If the CFTC wins the lawsuit, it could mean an end to the functioning of the exchange platform and the complete closure of operations.

Here’s What the CFTC is Alleging

After thorough investigations spanning years, the CFTC has claimed that Binance has violated the U.S. commodities law with its “illegal” exchange and “sham” compliance program. The CFTC argues that Binance and CZ have willfully evaded the law to their own benefit by directing employees to carry on unlawful practices and circumvent compliance controls.

At the heart of the complaint is Binance’s illegal practice of carrying out commodity derivatives transactions for U.S. customers without registering with the agency. The CFTC alleges that Binance, along with another American firm, BAM Trading, carries out derivative trading for U.S. customers. It is important to note that BAM is actually owned and managed by CZ himself.

Moreover, the CFTC cited that Binance “failed to implement basic compliance procedures designed to prevent and detect terrorist financing and money laundering.” On direction from CZ, Binance employees renamed important U.S. customer accounts and continued trading on their behalf without following regulatory procedures. Binance also does not require customers to register their identities with them before trading.

The CFTC also alleges that CZ has about 300 house accounts that are used for trading and routing illicit money and are exempt from the company’s insider trading norms.

To that effect, the CFTC seeks “disgorgement, civil monetary penalties, permanent trading and registration bans, and a permanent injunction against further violations of the CEA and CFTC regulations, as charged.”

CZ’s Reply to the Charges

In response to the CFTC’s “unexpected and disappointing civil complaint,” CZ put out a statement to gain customer confidence and clarify Binance’s stance. To begin with, CZ has disapproved of the allegations pertaining to the willful evasion of the law. The letter states that Binance undertakes a mandatory KYC declaration of customers before engaging them and blocks U.S. nationals based on a combination of factors.

Furthermore, Binance employs over 750 compliance officers who thoroughly supervise all practices. CZ also stated that Binance has in the past and will continue to “respect and collaborate with US and other regulators around the world.”

CZ also clarified that he has two accounts and is required to convert his crypto holdings into cash to pay for personal expenses. They also restrict any insider trading actions and require employees to hold the coins for 90 days before allowing any trade. To sum up, CZ noted that Binance follows strict procedures in running its exchange platform and denied all wrongdoing alleged by the CFTC.

Binance Coin (BNB-USD)

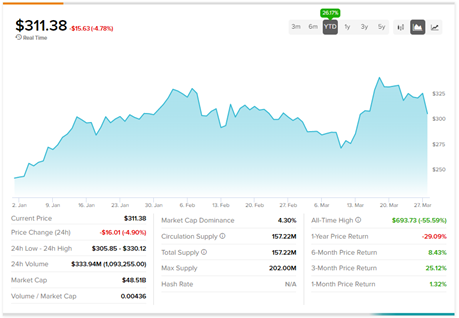

Binance’s own cryptocurrency, Binance Coin (BNB-USD), fell 4.9% on March 27, following the CFTC’s suit. Nevertheless, BNB has gained 26.2% so far in 2023, while it lost 28.4% in the last year.