It might sound counter-intuitive, but there’s word afoot that sports betting platform DraftKings (NASDAQ:DKNG) might be in line for gains as it potentially gets new competition in the field from Flutter Entertainment (DE:PPB). And with DraftKings up around 1.5% in Monday afternoon’s trading, the thesis may not be as preposterous as it might sound on the surface.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Reports note that Flutter is joining the New York Stock Exchange under the ticker symbol FLIT. That’s seeing its primary listing move from the London exchange to the New York exchange, though the process must go through shareholder approval to complete. If it does, reports note, that will set up Flutter as a potential competitor to DraftKings as a “pure-play sports betting” operation.

A Major Sea Change Afoot

Yet, here’s where things get interesting. Flutter is stepping into a field that already has a couple of major participants divvying up the market. DraftKings is one of the major players, of course—some argue it’s the only real pure-play betting system in the market—but the current leader is FanDuel. FanDuel currently holds 43% of the gross revenue and 51% of the net revenue. Still, DraftKings has been on the rise over the last 12 months and is making a serious play for that market. With Flutter getting involved, its primary target is going to be FanDuel, and if Flutter pulls market share from FanDuel instead of DraftKings, then DraftKings’ new competitor might be doing it a favor after all.

Is DraftKings a Good Stock to Buy Now?

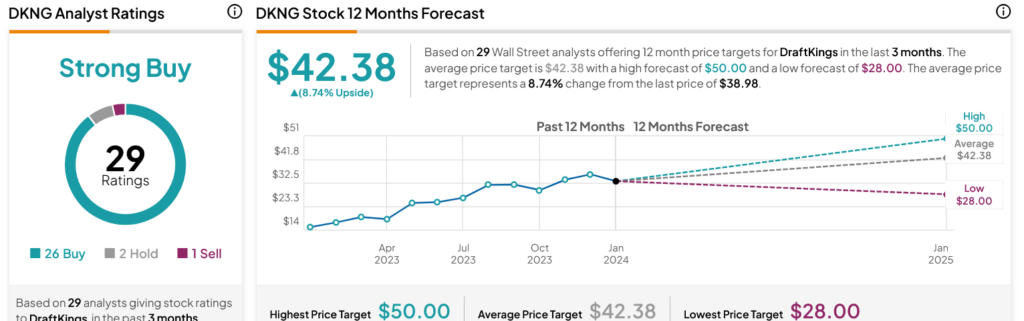

Turning to Wall Street, analysts have a Strong Buy consensus rating on DKNG stock based on 26 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 167.03% rally in its share price over the past year, the average DKNG price target of $42.38 per share implies 8.74% upside potential.