WalkMe (WKME), a cloud-based digital adoption platform, reported its Q2-2022 earnings results earlier today. Both revenue and earnings per share (EPS) topped analyst estimates. As a result, the stock finished 9.2% higher today.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Here are some key highlights from WKME’s Q2 earnings report:

- Revenue grew 28% year-over-year, reaching $59.9 million and beating estimates by about 0.9%. Subscriptions made up 90.5% of sales and grew at the same rate.

- Earnings per share were -$0.19 compared to EPS of -$0.16 in Q2 2021, beating the consensus estimate of -$0.23.

- Remaining Performance Obligation (RPO), calculated as a company’s backlog + deferred revenues, came in at $346 million, increasing 33% compared to the prior-year period.

- Free cash flow was -$12.2 million for the quarter. In Q2 of last year, the company lost only -$7.4 million.

- Annual recurring revenue from Digital Adoption Platform users increased 60% year-over-year.

- The company had cash and equivalents of nearly $318 million at the end of the quarter.

WKME also provided Q3 and full-year guidance. It expects Q3 revenue to grow about 24% to 25% year-over-year and its non-GAAP operating earnings to be between -$15.5 million to -$16.5 million. For the full year, revenue is expected to grow by 27% to 29%, and operating income should range from -$65 million to -$68 million.

Website Traffic Hinted at Strong Revenue Growth

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into WalkMe’s performance this quarter.

According to the tool, WalkMe’s website recorded a 115.2% rise in global visits in Q2, compared to the same period last year. Moreover, year-to-date, WKME’s traffic increased by 82.99% compared to the previous year. This explains the company’s solid revenue growth for the period.

Is WKME a Good Stock to Buy?

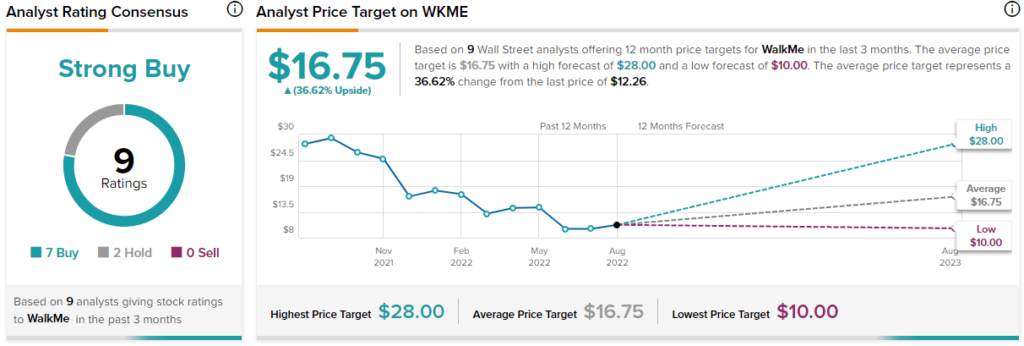

Turning to Wall Street, WalkMe has a Strong Buy consensus rating based on seven Buys and two Holds assigned in the past three months. The average WalkMe price target of $16.75 implies 36.6% upside potential. Price targets range from a low of $10 to a high of $28. With the stock currently at $12.26, the high price target implies that the stock could potentially more than double from here.

Conclusion: A Solid Earnings Beat, but No Profitability

WKME did well to beat both EPS and revenue expectations in Q2. The company is experiencing strong growth, and it looks like this growth will continue. However, its losses are expanding, which is not the greatest sign.

Nonetheless, it can maintain those losses right now as it has no debt and a large amount of cash that makes up over 30% of its market cap. Analysts are also very bullish on the stock. Therefore, even though it is generating losses, it may be a stock worth considering for growth investors.