Shares of mining giant Rio Tinto (RIO) were down around 4% in pre-market trading on Thursday after the company signed a Memorandum of Understanding (MoU) with South Korea’s largest steelmaker POSCO. Both companies will work together on various technologies to achieve low-carbon emissions across the entire steel value chain.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The partnership is a step towards both Rio Tinto’s and POSCO’s long-term ambitions of achieving net-zero carbon emissions by 2050.

The alliance will integrate Rio’s iron ore processing capabilities with POSCO’s steelmaking expertise to evaluate possible ways to reduce carbon emissions throughout the steel value chain, from the mining of iron ore to the final production of steel.

In pursuit of its net-zero goal, Rio Tinto has signed similar partnership agreements with several other steel producers, including China’s Baowu Steel Group, and Japan’s Nippon Steel Corporation.

Rio Tinto has actively been working on the climate change issue for over twenty years and has reduced its emissions by more than 30% in the past ten years. (See RIO stock charts on TipRanks)

Furthermore, Rio Tinto plans to reduce carbon intensity by 30% and absolute emissions by an incremental 15% by 2030.

Notably, it has also created a $1 billion fund to finance projects related to climate change and the betterment of the environment.

Simon Farry, VP of Iron Ore Sales and Marketing at Rio Tinto, commented, “This partnership with POSCO, a valued and long-standing customer, demonstrates our combined commitment to working together to identify ways to reduce emissions across the steel-making process. The agreement also complements Rio Tinto‘s partnerships with other customers as the industry focuses on developing technologies that support the transition to a low-carbon economy.”

UBS analyst Myles Allsop recently downgraded Rio Tinto to Sell from Hold.

Allsop believes that iron ore has reached an inflection point and forecasts iron ore prices to fall around 50% from their current highs of around $220, based on an expected boost in the iron ore supply.

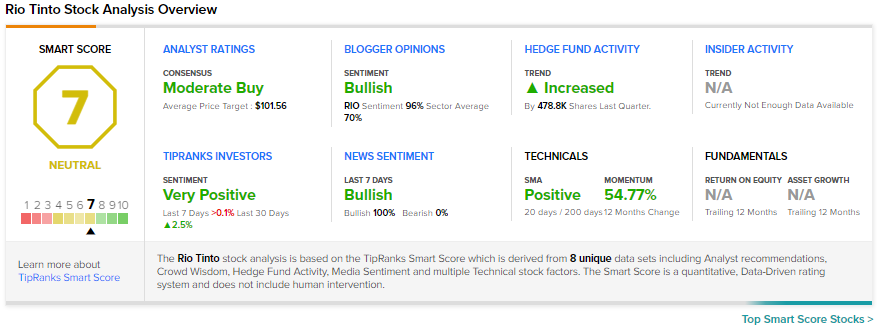

Consensus among analysts is a Moderate Buy based on 2 Buys and 1 Sell. The average Rio Tinto price target of $101.56 implies 24% upside potential to current levels.

Rio Tinto scores a 7 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations.

Related News:

Amazon Shares Leap 4.7% as Pentagon Cancels $10B JEDI Cloud Contract with Microsoft – Report

Why PFSweb Shares Climbed 42.7%: Here’s All You Need to Know

Spirit AeroSystems and Albany International Collaborate to Boost Hypersonic Capabilities