Morgan Stanley (NYSE: MS) has delivered better-than-expected results for the first quarter of 2022, benefiting from elevated advisory revenues. The company provides investment banking products and financial services to its clients.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Despite this promising beat, shares of MS rose a mere 0.75% on Thursday, as the company’s metrics compared unfavorably with the same quarter last year.

Results in Detail

Morgan Stanley reported adjusted earnings of $2.06 per share in the quarter, which easily topped the Street’s estimates of $1.71 per share. However, this represented a decline of 7% on a year-over-year basis.

Further, net revenues were $14.8 billion, down 5.7% from the prior-year quarter. Nonetheless, revenues beat analyst estimates by $1.05 billion.

Investment Banking revenues fell 37% year-over-year to $1.6 billion in the quarter. Outstanding performance in the advisory business was more than offset by lower revenues in equity underwriting. Additionally, Equity revenues jumped 10%, while Fixed Income revenue dropped 1.5%.

Meanwhile, Wealth Management revenues came in at $5.9 billion, down just 0.4% year-over-year, and Investment Management revenues of $1.3 billion rose 1.6% from the prior-year quarter. Markedly, the Eaton Vance acquisition and elevated average assets under management (AUM) drove asset management and related fees.

Capital Deployment

Morgan Stanley repurchased common stock worth $2.9 billion during the quarter. The company announced a quarterly dividend of $0.70 per share, which will be paid on May 13, 2022, to common shareholders of record as of April 29, 2022.

Wall Street’s Take

Following the recent Morgan Stanley earnings report, Goldman Sachs analyst Richard Ramsden reiterated a Buy rating and a price target of $105 (23.9% upside potential) on the stock.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on six Buys and six Holds. The average Morgan Stanley price forecast of $102.30 implies 20.7% upside potential. Shares have gained 4.9% over the past year, not including dividends.

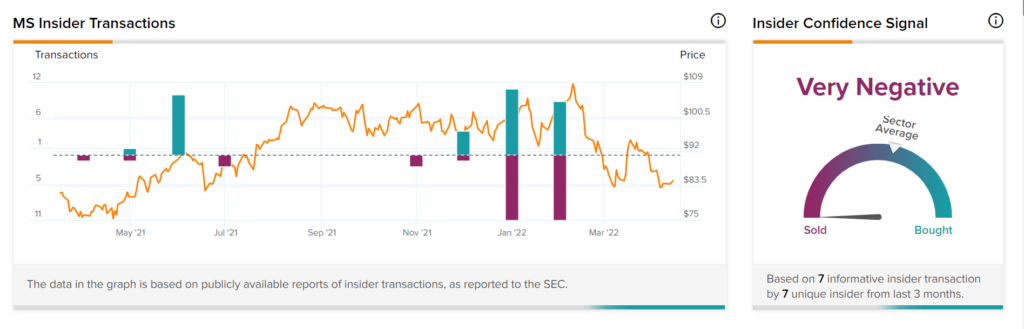

Insider Trading

Based on the recent corporate insider activity, corporate insider sentiment is Very Negative for Morgan Stanley. This means that over the past quarter, there has been an increase of insiders selling their shares of MS in relation to earlier this year.

The Takeaway

Though the company was able to beat Street’s expectations, there has been an overall decline in performance when compared to last year. Perhaps the lingering global uncertainty since the beginning of 2022 affected its business.

While the Federal Reserve’s move to raise interest rates may provide some respite, Morgan Stanley’s performance may continue to be impacted until market uncertainty is cleared. Furthermore, sentiments of hedge funds and insiders also replicate the thought.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Taiwan Semiconductor Stock Dips Despite Upbeat Q2 Outlook

Musk Puts Forth All-Cash Offer to Buy Twitter

Why Did Sierra Oncology Skyrocket on Wednesday?