Shares of Kratos Defense & Security Solutions (NASDAQ:KTOS) closed about 13% higher on Wednesday, June 21. The jump in KTOS stock followed the successful test of its Zeus 1 solid rocket motor (SRM). Overall, shares of this technology company, which develops products, platforms, and solutions for United States National Security-related customers, have gained more than 50% year-to-date.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company said that its Space & Missile Defense Systems Business Unit successfully conducted the first static test firing of its Zeus 1 SRM at Aerojet Rocketdyne’s (NYSE:AJRD) facility in Arkansas.

Kratos Stock Benefits from Improving Financials

Kratos is taking initiatives to drive year-over-year organic growth, enhancing profit margins and cash flows. Its recent investments and shift towards production and delivery from development in certain areas augur well for growth.

The company’s margins and cash flows are likely to increase in the second half of the year, reflecting the repricing of contracts due for renewal. Moreover, the stabilization of the supply chain and reduction in lead times will likely support its growth.

Earlier this month, Kratos was awarded a $46.7 million contract from NSWCDD (Naval Surface Warfare Center Dahlgren Division). Highlighting the recent contract wins, Noble Financial analyst Joe Gomes reiterated a Buy rating on KTOS stock on June 6. Gomes said, “We view the recent awards as further confirmation of the Kratos strategy in providing leading-edge disruptive technology products and systems.”

Further, the analyst finds KTOS’ valuation attractive, offering a “compelling risk/reward opportunity.”

Will KTOS Stock Go Up?

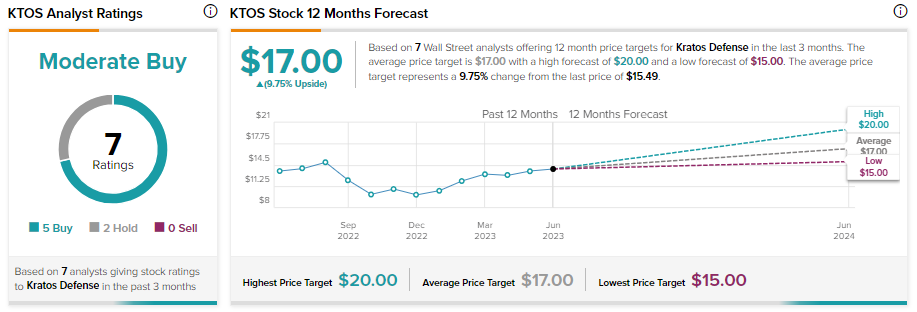

KTOS stock could benefit from a higher defense budget in areas such as space and satellite, hypersonic, and missile systems. It has received five Buy and two Hold recommendations for a Moderate Buy consensus rating. Meanwhile, analysts’ average price target of $17 implies 9.75% upside potential.