Shares of Warner Bros. Discovery (NASDAQ: WBD) were down 5% on April 27, after the U.S.-based global mass media and entertainment conglomerate reported mixed Q1 results, significantly beating earnings estimates. However, revenues fell short of expectations.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Investors were further dissuaded by the lowered outlook provided by the company based on lower-than-expected Q1 profitability.

Q1 Numbers

The company reported stellar quarterly earnings of $0.69 per share, significantly higher than analysts’ estimates of $0.27 per share and more than treble the earnings of $0.21 per share reported for the prior-year period.

However, revenues jumped 13% year-over-year to $3.16 billion but slightly fell short of consensus estimates of $3.17 billion. The revenue growth is attributed to higher U.S. advertising revenues that grew 5% and distribution revenues that increased by 11%.

Internationally, advertising revenues increased 5% while distribution revenues increased 4%.

Muted FY2022 Outlook

During its earnings call, management of the newly created media giant post the completion of the WarnerMedia-Discovery merger cautioned its investors of a difficult 2022 that will be “noisy” and “a little messier” than anticipated earlier.

Disappointed by the lower-than-expected Q1 operating profit and cash flows, CFO Gunnar Wiedenfels, stated, “I currently estimate the WarnerMedia part of our profit baseline for 2022 will be around $500 million lower than what I had anticipated, however, with the positive offsets of a couple hundred million dollars on the Discovery side of the combined company.”

CEO’s Comments

CEO of Warner Bros. Discovery, David Zaslav, commented, “With Warner Bros. Discovery, we are creating a pure-play media company with diversified revenues and the most compelling IP ownership, franchises, and brand portfolio in our industry.”

He further added, “We are putting together the strategic framework and organization to drive our balanced approach to grow our businesses and maximizing the value of our storytelling, news and sports.”

Wall Street’s Take

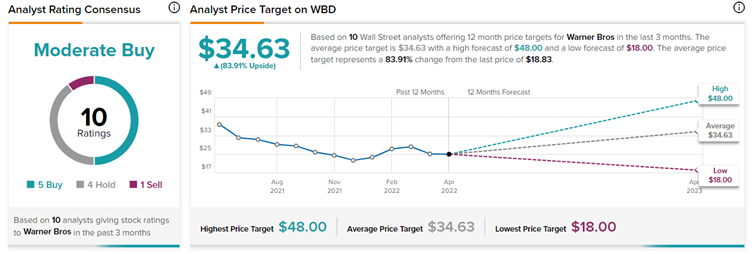

Following the results, Rosenblatt Securities analyst Barton Crockett reiterated a Sell rating on Warner Bros with a price target of $18 (4.4% downside potential). The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on five Buys and four Holds. The average Warner Bros price target of $34.63 implies 83.9% upside potential to current levels.

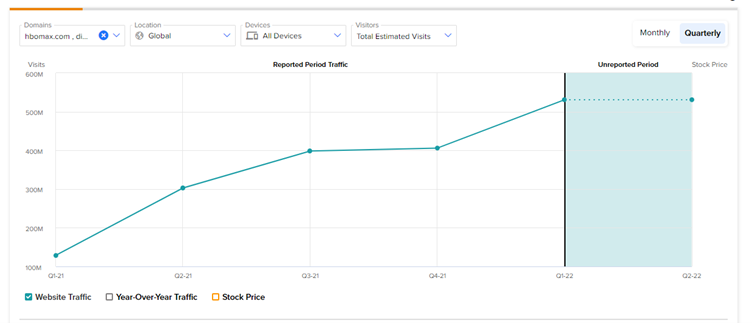

Warner Bros Website Traffic

TipRanks’ Website Traffic Tool provided insight into Warner Bros Q1 performance well ahead of its earnings.

According to the tool, in Q1, WBD’s website traffic, which includes hbomax.com, discoveryplus.com as well as warnerbros.com showed an increase in total visits from the previous quarter, and from the same quarter for the same period last year.

Conclusion

The company is putting in strategic initiatives to drive growth post-gigamerger and sail through the other macro challenges.

However, the lowered outlook is a cause of concern implying that the integration of the acquisition and the resulting synergies may take longer than previously anticipated.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Universal Health Stock Dips 11%: Mixed Q1 Results, Cloudy Outlook

Why HSBC Holdings Stock is Down Today

Lennox International Stock Falls Despite Q1 Beat & Improved Outlook