Applied Materials (AMAT) reported fiscal Q2 2022 results that showed improvements from the same quarter the previous year, but fell short of Wall Street expectations. Its forecast for the current quarter also turned out to be downbeat. As a result, AMAT stock dropped nearly 2% during extended trading on May 19, following the earnings report.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Applied Materials provides manufacturing equipment and process technologies used in semiconductor chip production. Its customers include chipmaking giants like Intel (INTC), Samsung Electronics (SMSN), and Taiwan Semiconductor Manufacturing (TSM). The reported results are for the three months ended May 1.

Earnings at a Glance

Revenue rose 12% year-over-year to $6.25 billion but fell short of the consensus estimate of $6.35 billion. Adjusted earnings per share (EPS) of $1.85 jumped from $1.63 in the same quarter the previous year, but missed the consensus estimate of $1.90.

While demand remains strong for Applied Materials’ products, the company is struggling to fulfill its orders because of supply chain challenges. The company sources some of the parts that go into its equipment from China but COVID-19 related lockdowns in the country have disrupted the supply of those components. The supply chain issues led to Applied Materials missing about $150 million in revenue in the quarter.

The company returned $2.01 billion to shareholders during the quarter, including $211 million in dividends and $1.8 billion in share repurchases.

Outlook

For Q3, Applied Materials anticipates revenue of $6.25 billion, give or take $400 million, which works out to a range of $5.85 billion to $6.65 billion. However, Wall Street is expecting revenue of $6.68 billion for the quarter. While Applied Materials guided adjusted EPS in the band of $1.59 to $1.95, the consensus estimate calls for EPS of $2.04.

Wall Street’s Take

Consensus among analysts is a Strong Buy based on seven Buys and two Holds. The average Applied Materials price target of $159.11 implies upside potential of 44% to current levels. Shares have retreated about 30% year-to-date.

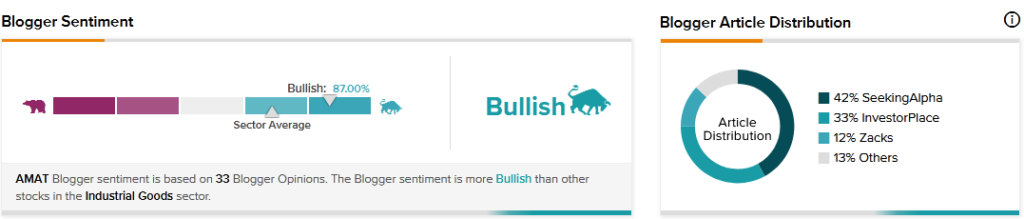

Blogger Opinions

TipRanks data shows that financial blogger opinions are 87% Bullish on AMAT, compared to a sector average of 69%.

Key Takeaway for Investors

The supply chain issues are only a temporary setback for Applied Materials. The company’s long-term prospects look promising as chip demand grows across industries.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Synopsys Stock Gets Wings after Impressive Q2 Performance

Burberry’s Fiscal 2023 Outlook Fails to Delight Investors

KKR Bolsters KKR Ascendant with Investment in Alchemer