Shares of Peloton Interactive, Inc. (NASDAQ: PTON) plunged almost 24% on January 20 to $24.22, erasing $2.5 billion in market capitalization in a single day.

The sharp decline was driven by news reports, which stated that the American exercise equipment and media company is temporarily halting production of its fitness bikes and treadmills due to a massive dip in demand.

However, the PTON shares recovered modestly, gaining 2.3% during the after hours trading session, following the preliminary second-quarter results announcement by the company and denial of the rumors by the CEO.

Investors were relieved as the profit warning issued by the company was not as dreadful as expected from the mid-day reports.

CNBC Report: Temporary Halt in Production of Bikes & Treadmills

Based on the internal documents obtained, CNBC reported on January 20 that in response to a slump in consumer demand and to control costs, Peloton is planning to stop producing its connected fitness products on a temporary basis.

The internal documents mentioned that Peloton plans to stop Bike production for two months starting in February. Furthermore, it will not produce its Tread treadmill machine for six weeks.

Earlier, it halted production of its premium Bike+ in December and will not restart production until June. In addition, it has no plans to renew production of Tread+ machines in 2022, which were recalled last year due to safety concerns.

According to CNBC, in a confidential presentation dated January 10, the company implied that there was a “significant reduction” in global demand for its connected fitness equipment due to consumers’ price sensitivity and higher competition.

Earlier, on January 18, CNBC had also reported that Peloton hired management consulting group McKinsey & Co to review its cost structure due to historically-high inflation levels and increased supply chain costs. According to the report, the company could possibly hike the bike prices by around 15%, potentially cut jobs, and consider store closures.

CEO John Foley Dismisses the Production Halt Rumors

According to Reuters, CEO John Foley dismissed the news regarding the production stoppage and said, “Rumors that we are halting all production of bikes and Treads are false.”

Foley further added, “We now need to evaluate our organization structure and size of our team…And we are still in the process of considering all options … to make our business more flexible.”

Putting some light on their strategic actions going forward, CEO Foley said in a company press release, “As we discussed last quarter, we are taking significant corrective actions to improve our profitability outlook and optimize our costs across the company. This includes gross margin improvements, moving to a more variable cost structure, and identifying reductions in our operating expenses as we build a more focused Peloton moving forward.”

Preliminary Q2 Results

Following the CNBC report, Peloton issued a press release announcing preliminary second-quarter results. CEO John Foley also stated that more details will be shared on the company’s plans going forward.

The company plans to report its upcoming earnings for the second fiscal quarter of 2022 on February 8.

For Q2, total revenues are now forecast to be $1.14 billion, near the low end of the previously guided range of $1.1 billion to $1.2 billion.

The company now anticipates adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the range of $(270) million to $(260) million, better than the previous guidance of $(350) million to $(325) million.

The company expects to report ending connected fitness subscriptions of approximately 2.77 million, lower than the prior guidance of 2.8 million to 2.85 million.

Slack in Demand Leads to Cost Control Plans

At the start of the COVID-19 pandemic, the company saw a strong boom in demand for its fitness classes and equipment. As a result, the company made incremental investments and bulked up its supply to match the unmet demand.

However, following a gradual ease in pandemic-related restrictions, the upsurge in demand faltered as customers returned to the gym and opted for other fitness options.

During the first quarter ended September 30, 2021, Peloton’s revenues grew only 6% year over year compared to a whopping 250% seen in the first fiscal quarter of 2020. It reported only 161,000 new connected fitness subscribers, the lowest addition recorded in eight consecutive quarters.

Consequentially, the company announced a hiring freeze in November and started evaluating ways to control costs like optimizing its marketing spending and curbing showroom development.

Wall Street’s Take

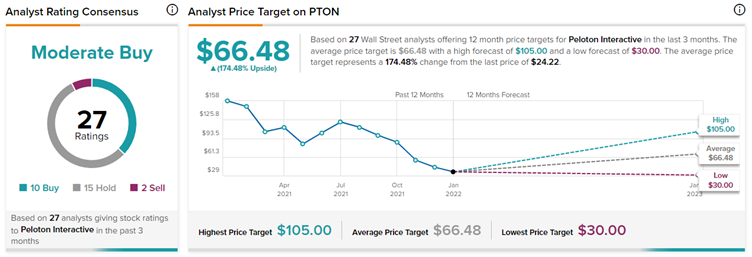

Yesterday, KeyBanc analyst Edward Yruma maintained a Buy rating on the stock with a price target of $60 (147.7% upside potential).

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 10 Buys, 15 Holds and 2 Sells. At the time of writing, the average Peloton Interactive stock forecast was $66.48, which implies 174.5% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

P&G Posts Q2 Beat & Raises Guidance; Shares Up 3.4%

Chesapeake Energy May Snap up Chief Oil & Gas for $2.4B – Report

Disney Forms International Hub to Bolster DTC Business