Shares of Cronos Group (CRON) declined 13.7% to close at $3.09 on Tuesday after the cannabis company delivered mixed second-quarter results amid its business restructuring initiatives.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

What Does Cronos Group Do?

Cronos Group is a global cannabinoid company that manufactures and sells cannabis, and hemp-derived supplements for the medical and adult-use markets in federally legal jurisdictions, including the U.S., Canada, and Germany. Its international brand portfolio includes Spinach, Peace Naturals, Lord Jones, Happy Dance And Peace+.

A Snapshot of CRON’s Q2 Performance

The company reported an adjusted loss of $0.05 per share, which was just a cent less than the street’s estimated loss of $0.06. Comparatively, the current quarterly loss was narrower than the loss of $0.48 reported in the prior-year quarter.

However, revenues of $23.1 million jumped 48% year-over-year but lagged the $28.35 million consensus.

The revenue growth is attributed to higher Rest of World revenues, especially in Israel’s medical market where net revenue grew a whopping 212% year-over-year to $7.2 million during the quarter.

At the end of the second quarter, the company reported cash and cash equivalents of $789.54 million, lower than the $895.18 million reported in the same period last year.

Commenting on the business realignment progress, Cronos CEO Mike Gorenstein stated, “Our supply chain transformation in Canada is going very well, with GrowCo achieving profitability in the year-to-date period, and the operational efficiencies we envisioned when we embarked on this initiative are starting to be realized.”

With respect to the U.S., he added, “Although early in the repositioning of our U.S. business, we are confident the new strategy will improve our bottom-line while maintaining brand equity that we can leverage into cannabinoids beyond CBD, and in the U.S. THC market once regulations permit.”

The company also stated that it may incur $6.4 million in expenses with respect to the business realignment, higher than the previously anticipated expense of $5.8 million.

Is CRON a Good Stock to Buy?

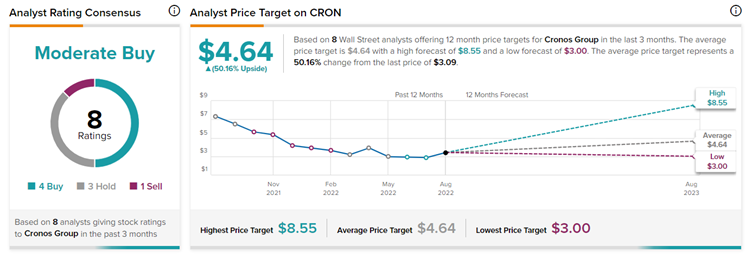

As of now, the Street is both optimistic and cautious about CRON stock. On TipRanks, analysts have a Moderate Buy consensus rating on the stock, which is based on four Buys, three Holds, and one Sell.

Following the company’s second-quarter results, Tamy Chen of BMO Capital lowered her price target on Cronos Group to $3.30 (6.8% upside potential) from $3.50 and reiterated a Hold rating on the stock.

Chen believes, “The top-line miss was more a catch-up of sell-in to sellthrough over the past three quarters than a reversal in underlying rec momentum. It is encouraging to see CRON make good strides to narrow the EBITDA loss so far vs. 2021.”

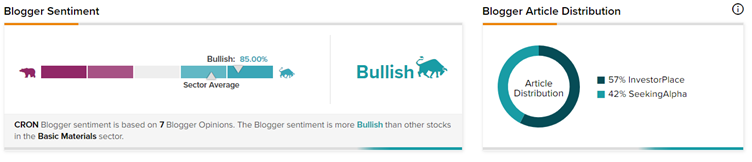

Meanwhile, TipRanks data shows that financial bloggers are 85% Bullish on CRON stock, compared to the sector average of 73%.

What Is the Future of CRON Stock?

Cronos’ average price forecast of $4.64 implies 50.16% upside potential from the current level. The company is in the middle of a business transition, with a phased exit from its wholesale beauty category. Upon completion, the company will solely focus on adult-use products, boosting its product development and long-term focused innovation.

CRON stock is down more than 55% over the past year. However, it has recovered 5% in the last 30 days. The current share price represents a good entry point to the potential upside the stock may offer if the growing international legalization momentum becomes a reality.

Read full Disclosure