Boeing (BA) has reported strong deliveries for the month of June 2022, crossing the 50 benchmarks for the first time in a span of more than three years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the news, shares of the world’s largest aerospace company and the leading manufacturer of commercial jetliners and defense systems gained 7.4% on July 12 to close at $147.15.

Robust June & Q2 Deliveries for BA

In June, Boeing reported 51 airplane deliveries, bringing the total deliveries for the first half of the year to 216. This implies a 38% growth from the first half of FY2021.

Notably, the June deliveries included 43 Boeing 737 MAX, which have been struggling with safety crisis issues for almost two years.

However, deliveries did not include any 787 Dreamliners, which have been suspended for a year now as Boeing continues to hold talks with the regulators regarding production issues.

For the second quarter of FY22, commercial deliveries came in at 121 aircraft, higher than 79 aircraft for the prior-year quarter (2Q21) and sequentially up from 95 for the previous quarter.

The company is scheduled to report its second quarter earnings on July 27.

Wall Street Analysts’ Bullish Take

Following the delivery numbers release, Goldman Sachs analyst Noah Poponak reiterated a Buy rating with a price target of $288 on Boeing.

Sharing his optimism, Poponak commented, “We expect to see a continued recovery in air traffic and desire for more fuel efficient aircraft driving continued solid order activity moving ahead, with the Farnborough Airshow a possible catalyst.”

He further added, “We expect the pace of deliveries to accelerate through the end of the year with China a possible near-term catalyst. There were 0 787 deliveries, which we expect to restart soon.”

Impressed by the strong delivery numbers, another analyst, Ken Herbert, from RBC Capital, reiterated a Buy rating with a price target of $220 (49.51% upside potential).

He highlighted, “The delivery numbers were a positive, reflecting improvement in the outlook for the 737 MAX as June MAX deliveries were ~43, up from just ~30 in May (reflecting the production pause)”

He further stated, “Boeing also signed 119 gross orders in the quarter. The company continues to have ~310 MAX aircraft in inventory, and ~120 787s.”

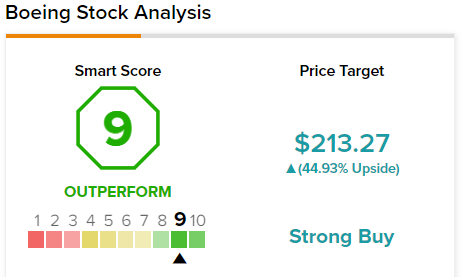

With 14 Buys and three Holds, the stock commands a Strong Buy consensus rating. The average Boeing price target of $213.27 implies 44.9% upside potential to current levels.

High TipRanks Smart Score for BA

BA scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Bottom-Line

Shares of Boeing have lost a third of their market capitalization in the past six months.

The strong rebound in the deliveries as seen in the second quarter is a strong positive for the stock. Furthermore, expected resumption of 787 aircrafts could act as another driver for earnings.