Aussie miner, 29Metals’ (ASX:29M) shares rocketed up as much as 14%, to a high of AU$2.35 in morning trading, before easing back to around 10% in the afternoon. The surge came after the company announced the five-year extension of an underground mining services agreement at its Golden Grove mine in Western Australia.

Other ASX shares rising alongside 29Metals stock in morning trading, included Premier Investments Limited (ASX:PMV), Adore Beauty Group (ASX:ABY), and Ramelius Resources Limited (ASX:RMS).

29Metals and Byrnecut renew mining contract

29Metals is a copper focused and precious metals mining company. In 2017, the company hired Byrnecut to provide contract underground mining services at its Golden Grove mine in Western Australia.

In deciding to extend the contract, 29Metals stated that retaining Byrnecut would ensure continuity of operations at the mine.

“There is a strong alignment between our two companies from an operations, performance, and values perspective. With the new contract, we are extending that alignment to include a commitment to collaborate on Sustainability & ESG matters,” commented 29Metals CEO, Peter Albert.

In addition to high-grade copper, the Golden Grove mine also contains lead, zinc, gold, and silver. The site has been mined for years, starting in 1989. Byrnecut has been a long-time 29Metals partner on Golden Grove’s mining operations.

29Metals share price forecast

29Metals shares have gained about 18% over the past three months, but are 30% lower from the start of the year. According to TipRanks’ analyst rating consensus, 29Metals stock is a Moderate Buy.

The recent spikes have seen 29Metals’ share price jump ahead of analysts’ estimates, with the current average stock price forecast of AU$2.08 implying about 9% downside potential.

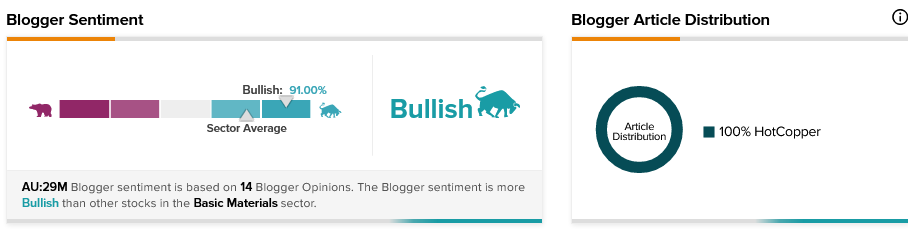

29Metals stock is receiving positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 91% Bullish on 29Metals, compared to a sector average of 74%.

Closing remarks

29Metals recently delivered strong financial results amid favourable metal prices. The shift to electric vehicles and renewable energy is expected to boost copper demand and prices over the long-term, which would benefit companies like 29Metals.