Shares of Affirm Holdings Inc. (AFRM) plunged as much as 17% on December 16, after the Consumer Financial Protection Bureau (CFPB) launched a probe into the company’s “Buy Now Pay Later” (BNPL) scheme.

Shares ended the day down 10.6% at $99.24 and continued its downward spiral by 2.3% during the extended trading session.

Affirm provides point-of-sale payment solutions for digital and mobile users, as well as merchant commerce solutions. The company is a major player in the BNPL space, which has gained huge momentum and attraction during the pandemic-stricken period.

AFRM shares have lost 34.6% in the past month alone, against a modest year-to-date gain of 2.1%.

What Happened?

Yesterday, the CFPB announced a probe into the BNPL players including Affirm, Paypal Holdings (PYPL), Afterpay, Klarna, and Zip. The Bureau said it is concerned about the accelerated pace at which these companies are offering consumer credit, with multiple loan schedules spanning multiple purchases with multiple finance companies.

In a typical BNPL offer, a consumer can buy the product right away and delay payments in a series of installments over a specified time frame, thus accumulating loads of debt without realizing the actual burden.

Another problem concerning the CFPB is data harvesting, which is used by merchants to target consumers, especially young shoppers, by offering easy payment options.

The CFPB is also working with international partners in Australia, Sweden, Germany, and the U.K., specifically the Financial Conduct Authority, in connection with the inquiry.

Bureau Comments

Commenting on the issue at hand, the CFPB Director, Rohit Chopra, said, “Buy now, pay later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately too… We have ordered Affirm, Afterpay, Klarna, PayPal, and Zip to submit information so that we can report to the public about industry practices and risks.”

Chopra concluded, “The Bureau would like to better understand practices around data collection, behavioral targeting, data monetization, and the risks they may create for consumers.”

Analysts’ Take

Recently, Mizuho Securities analyst Dan Dolev lowered the price target on the stock to $140 (41.1% upside potential) from $180, and maintained a Buy rating.

Dolev said, “While BNPL is a strong growth engine and will likely increasingly expand its presence in the US in the coming years, our research uncovers several potential risks that we believe are not fully understood.”

Some of these risks include, rising charge-offs and delinquencies, missed payments, high debt, and limited financial flexibility across lower income brackets. Given these headwinds, the Dolev has lowered price targets on multiple players in the segment.

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 5 Holds. The average Affirm price target of $161.50 implies 62.7% upside potential to current levels.

Website Traffic

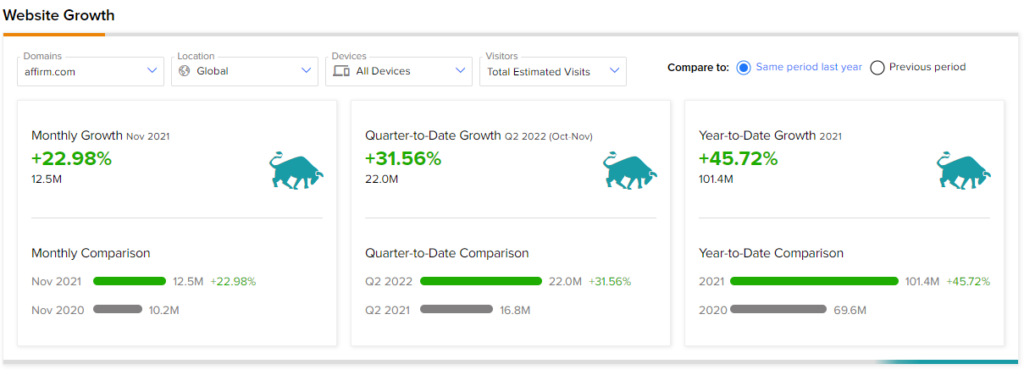

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into AFRM’s performance.

In November, Affirm website traffic recorded a 22.98% year-over-year increase in monthly visits. Similarly, year-to-date website traffic growth grew by 45.72% compared to the same period last year.

Related News:

Eli Lilly Impresses at Investment Community Meeting

Roblox Releases Poor November Metrics; Shares Plunge 9%

Lowe’s 2022 Guidance Misses Estimates; Shares Up 2%